236.3 Administration: Difference between revisions

m Per RW, updated Form A419 |

m Per RW, updated Form A419 |

||

| Line 5: | Line 5: | ||

|[[media:236 Form 3.4.2 June 2013.docx|Acquisition Authority Date, A-Date (Form 3.4.2)]] | |[[media:236 Form 3.4.2 June 2013.docx|Acquisition Authority Date, A-Date (Form 3.4.2)]] | ||

|- | |- | ||

|[[media:236.3 Form A419 | |[[media:236.3 Form A419 Dec 2014.docx|Acquisition Payment (Form A-419)]] | ||

|- | |- | ||

|[http://epg.modot.mo.gov/forms/RW/Chapter%203_Administration/Categorical%20Exclusion%20Review_Form%203-1_2.dot Categorical Exclusion Review (Form 3.1.2)] | |[http://epg.modot.mo.gov/forms/RW/Chapter%203_Administration/Categorical%20Exclusion%20Review_Form%203-1_2.dot Categorical Exclusion Review (Form 3.1.2)] | ||

| Line 477: | Line 477: | ||

Financial Services Division establishes one or more unique accounting number(s) for each right of way project when an A-Date is issued. This accounting number is termed the SAM II Project Number. The SAM II Project Number is available to district and division users by querying the SAM II system, and is also maintained on the Job List in RWPA. | Financial Services Division establishes one or more unique accounting number(s) for each right of way project when an A-Date is issued. This accounting number is termed the SAM II Project Number. The SAM II Project Number is available to district and division users by querying the SAM II system, and is also maintained on the Job List in RWPA. | ||

The district right of way office will forward, along with the correct accounting coding, all required documentation and data for right of way payrolls and relocation claims (payments) to the Right of Way Section. Documentation required for processing payment for land acquisition by negotiation shall include a certified escrow agreement or certified sales contract, [[media:238.2.17 Professional Land Surveyor 2012.doc|Form 238.2.17 Professional Land Surveyor Description Review Form]], and a right of way [[media:236.3 Form A419 | The district right of way office will forward, along with the correct accounting coding, all required documentation and data for right of way payrolls and relocation claims (payments) to the Right of Way Section. Documentation required for processing payment for land acquisition by negotiation shall include a certified escrow agreement or certified sales contract, [[media:238.2.17 Professional Land Surveyor 2012.doc|Form 238.2.17 Professional Land Surveyor Description Review Form]], and a right of way [[media:236.3 Form A419 Dec 2014.docx|Acquisition Payment (Form (A-419)]] for each parcel. If an administrative settlement is reached the administrative settlement memorandum is a required attachment. In order for a check to be issued or electronic funds transfer to occur the payee must have a vendor number. This vendor number can be obtained by filling out the [http://oa.mo.gov/acct/pdffiles/vendor_input_ach_eftd.pdf Vendor Input/ACH-EFT Application Form] provided by the Office of Administration (OA) and submitting that form to OA. The payee's vendor number is to be included on the Acquisition Payment (Form A-419). | ||

The payroll packet may be submitted through inter-office mail or by emailing scanned “pdf” files. All required documentation is still required. | The payroll packet may be submitted through inter-office mail or by emailing scanned “pdf” files. All required documentation is still required. | ||

Revision as of 08:28, 24 December 2014

236.3.1 General

236.3.1.1 Administration responsibilities

The Right of Way administration responsibilities are:

- establish and maintain the records, charts, statistics and files as necessary for a coordinated acquisition program;

- assist in the scheduling of right of way projects and preparation of estimates for right of way, relocation, and incidental costs of acquisition; assign right of way staff to participate on core teams and project teams;

- monitor right of way project progression in accordance with the Statewide Transportation Improvement Program, assuring that all phases of the right of way function are initiated with appropriate lead time for completion as scheduled;

- prepare bid proposals for submission to title companies, abstract companies, etc., for furnishing Phases 1, 2, and 3 title information, including the scheduling of same to assure the smooth flow of information necessary for preparation of plans, appraisals, negotiations and closing transactions;

- prepare and submit agreements as necessary for Commission approval and execution;

- schedule and submit requests for program approval, acquisition authority and funding for right of way projects, including necessary estimates, plans, relocation studies, etc.;

- prepare and update monthly project status reports;

- prepare all deeds, write and/or check legal descriptions for acquisition of land, access rights, property rights and easements and the disposal of excess right of way, excess land, uneconomic remnants and maintenance sites;

- obtain district Public Land Surveyor’s (PLS) review of legal descriptions for acquisitions and disposals. For additional information see EPG 238.2.6 and EPG 236.4.6;

- prepare and furnish Financial Services the correct accounting identification and documentation for preparation of payrolls for acquisition of right of way, relocation payments, and incidental expenditure in compliance with established right of way and accounting procedures; Sam II Chart of Accounts, Object Codes;

- receive and distribute vouchers in payment for right of way acquisition and related programs;

- receive and submit receipts from sales of real estate, improvements, and deposits for performance;

- receive and submit receipts for the initial rent and lease accounts. All other rent and lease payments should be sent direct to Financial Services;

- receive, process and distribute correspondence as necessary for the district and Right of Way Section operation;

- obtain categorical exclusion determination in connection with all airspace agreements, lease agreements, disposals, hardship/protective acquisitions, and relinquishments for compliance with 23 CFR 771.117 (d).

236.3.1.2 Steps for Completing Categorical Exclusion (CE) Review

District right of way will complete Section A Categorical Exclusion Review (Form 236.3.1.2). Submit with attachments to the Design Division, Environmental Section for their determination that this action meets the criteria for a CE.

The Design Division, Environmental Section will complete Section B of the form to arrive at CE determination and return to District right of way.

On Interstate and Major Bridge projects district right of way will send the CE Request to the Right of Way Section who will submit the completed Form 236.3.1.2 to the Federal Highway Administration for their review and approval.

District right of way will submit the completed form with all other necessary documents to Right of Way Section for review and approval of airspace agreements, lease agreements, disposals, and hardship/protective acquisitions.

In addition to coordinating with the various districts on the above, it is Right of Way Section’s responsibility to develop the administration policies and procedures necessary for compliance with MoDOT needs and Federal Highway Administration requirements.

The following sections of this article describe the policy and procedure requirements for the administration responsibilities as listed above.

236.3.2 Programming and Right of Way

236.3.2.1 Programming

MoDOT’s program for right of way acquisition is included in the Statewide Transportation Improvement Program (STIP) as prepared and assembled by the Transportation Planning Division and annually approved by the Missouri Highways and Transportation Commission. The districts are responsible for identifying those projects that will be included in the STIP and completing the SIMS Forms with the appropriate project information.

The program is MoDOT’s right of way and construction plan and is based on available funds from all sources of income, improvement and rebuilding needs throughout the state, and priorities and capabilities of the various districts and divisions of the department.

The program is a carefully prepared and comprehensive schedule for a coordinated plan of right of way acquisition and construction for the various systems within the department's network of highways.

It is the responsibility of district right of way to furnish accurate estimates of the funds needed for the proposed right of way acquisition. The final program is presented annually to the Missouri Highways and Transportation Commission for review and approval.

The Statewide Transportation Improvement Program is the definite control over right of way acquisition insofar as scheduling and funding is involved. Extreme care must be taken to ensure that each job reflected in the program contains the latest available estimate of cost (Note: the programmed amount cannot be changed if the project is in the current fiscal year) and that the capabilities of the district staff are such that acquisition reflected in the program can be accomplished as planned.

236.3.2.2 Yearly Review of Program

Each year the districts identify those projects that will be included in the STIP. Each job estimate should be carefully reviewed at this time and revised estimates should be furnished to the project manager. Careful planning prior to this review should eliminate the necessity of numerous revisions to the program subsequent to Commission approval of a project for the active fiscal year.

The programmed amounts shown in the STIP for the current fiscal year cannot be changed. It is important to make sure that at some point during the fiscal year an "A-Date" is issued or the programmed funds will not rollover to the next fiscal year. See EPG 236.3.4 for the requirements necessary for issuing an A-Date. The programmed right of way dollars do not have to be spent during the fiscal year in which they are programmed. Once an A-Date is issued, the funds will be rolled over to subsequent years until the project is cleared.

236.3.2.3 Construction and Right of Way Program Control

The Right of Way Section is authorized to acquire right of way for the amounts on the Commission-approved program, as long as the total acquisition expenditures do not exceed the total approved programmed amount. When the total expenditures will exceed the total Commission-approved amount, a revision to the program is to be considered.

236.3.2.4 Revision of Programmed Amounts

It is up to the project manager and district right of way to identify any needed revisions to the right of way programmed amount contained within the STIP.

If there is a significant change in the right of way cost estimate for a project, district right of way should advise the project manager. The project manager advises the planning coordinator who balances the district STIP budget. If additional funds are needed for a project, the planning coordinator coordinates any funding shifts within the district STIP budget. For projects that come out of the district STIP budget, the project manager or planning coordinator completes a SIMS form, which is forwarded to the district engineer for approval. Changes that only affect the districts STIP budget require approval by the district engineer.

Major projects are funded at least partially from statewide funds and are fixed by project. Changes to these projects require approval from both the district engineer and the Transportation Planning Director.

236.3.3 Right of Way Plan Review

236.3.3.1 Right of Way Plan Review

Plans for right of way acquisition are prepared by district design and approved by the district engineer in the respective districts.

District right of way shall review plans and coordinate any requirements or recommendations with district design. When the plans are finalized and accepted for right of way use, and an A-Date is requested by submittal to the Right of Way Section by the district along with one set of approved right of way plans. District design will furnish copies of any subsequent revisions to the plans to district right of way with a transmittal letter that individually identifies the revisions being submitted. Right of way plans as acquired will be furnished to the Right of Way Section with the submittal of the Right of Way Clearance Certification. It is essential that cooperation, communication and coordination between district design, including the transportation project manager and core team members, and district right of way be maintained in the development of plans and the estimate of costs for right of way acquisition.

For more information on right of way plan development see EPG 236.13.7 Plan Development.

236.3.3.2 Right of Way Cost Estimates

All right of way cost estimates shall be prepared by district right of way upon request from district design and/or the transportation project manager. (Refer to EPG 124.1.1 Quality Control.) Requests may take on a format agreeable to the parties involved, and may be for individual jobs or lists of unchanged projects that require update.

If right of way were to initiate a cost estimate activity prior to a request from district design or the transportation project manager, project status may be documented on Right of Way Cost Estimate (Form 3.3.3B), to satisfy the request requirement.

A. Plan Detail Necessary for Right of Way Cost Estimates

All right of way cost estimates shall be prepared by district right of way in coordination with district design and the transportation project manager.

If plans are not available, district design shall furnish the most complete project information available including, but not limited to, the project development stage, type of improvement being considered, the length of the project, the widths of the proposed new right of way, the type and location of anticipated interchanges, the type and extent of access controls and a recent aerial photograph or map of the area with the proposed line or corridor of improvement drafted in as much detail as possible. If the plans have changed since the last estimate, or estimates of multiple scenarios of a project are sought, district design should identify changes and assign scenario titles, so that the project history and growth of each scenario can be tracked.

B. Estimates for Project Initialization

Estimates at the Project Initialization stage should be prepared in as much detail as possible from the limited scope that is available at the time, with the understanding that the programmed amount may not require updating until the project is placed on the approved Statewide Transportation Improvement Program (currently the 5 year program) several years later.

Updating of projects beyond the approved program ("future projects" outside 5 years) may require individual attention by district right of way, or may be updated by factors. A determination of what detail of update is necessary for the future projects will be made on a statewide basis, prior to each programming cycle.

C. Estimates for Projects on the Approved Program

Projects within the approved program (currently the five year program) should be prepared in as much detail as possible from the design information that is available at the time. This may include projects in the Project Initialization stage. Estimates for projects within the approved program must be updated at least annually and at milestones of plan development.

Right of way cost estimates are prepared and updated annually, to correspond with programming requirements for the fiscal year ending June 30. Estimates may be prepared or updated after September first of each year for the upcoming estimate cycle.

D. Use Of Right of Way Forms

All right of way cost estimates will use the Right of Way Cost Estimate Worksheet (Form 3.3.3A) to update information pertaining to cost estimates. Estimates based on comparative unit cost methods (cost per mile, etc.) may be prepared on a letter or memo format identified as a replacement for the Worksheet (Form 3.3.3A) in the Project Initialization and Conceptual Plan/Location Study Completion stages.

The estimate conclusions for right of way and incidentals will be transmitted to district design using the Right of Way Cost Estimate Transmittal (Form 3.3.3B). The following instructions assure procedural uniformity by the districts in the development and submission of right of way cost estimates.

The Right of Way Cost Estimate Transmittal (Form 3.3.3B) will be sent to the district design engineer and the transportation project manager. The Right of Way Section will receive copies at the Right of Way Plan Completion.

E. Use of Forms for Each Stage of Project Development

- 1. Project Initialization

- This estimate is made when a project is first placed on the Statewide Transportation Improvement Program and may stay in this plan development stage through subsequent programming cycles.

- Information for making a right of way estimate at this stage is normally tentative since the exact location, scope, design, extent of right of way required, damages, and relocation have not been determined. Utilizing information provided by district design, prepare a Right of Way Cost Estimate Worksheet (Form 3.3.3A) and Right of Way Cost Estimate (Form 3.3.3B). In the transmittal form, provide explanation for any change in the cost estimate conclusion from the previous estimate if any.

- Overall comparative unit costs (cost per mile, for example) may be used, without use of a worksheet, if a highly similar completed project is available for comparison. If a unit cost comparison is used the estimate shall reflect costs for right of way and incidentals separately and shall include data on the comparable project and calculations leading to a cost conclusion.

- 2. Conceptual Plan/Location Study Completion

- This estimate is prepared by district right of way for the various alignments and scopes of work being considered by district design.

- Utilizing information provided by district design, prepare a Right of Way Cost Estimate Worksheet (Form 3.3.3A) and Right of Way Cost Estimate Transmittal (Form 3.3.3C). The cost estimate for each alternative alignment shall have a separate worksheet and transmittal. In the transmittal, provide explanation for any change in the cost estimate conclusion from the previous estimate.

- Overall comparative unit costs (cost per mile, for example) may be used, without use of a worksheet, if a highly similar completed project is available for comparison. If a unit cost comparison is used the estimate shall reflect costs for right of way and incidentals separately and shall include data on the comparable project and calculations leading to a cost conclusion.

- 3. Preliminary Plan Completion

- This estimate is prepared after final determination of location has been made and a preliminary plan is furnished to district right of way by district design. The preliminary plan may indicate areas of taking and parcels to be affected.

- Utilizing preliminary plans provided by district design, prepare a Right of Way Cost Estimate Worksheet (Form 3.3.3A) and Right of Way Cost Estimate Transmittal (Form 3.3.3C). In the transmittal, provide explanation for any change in the cost estimate conclusion from the previous estimate.

- 4. Right of Way Plan Completion

- This estimate is made when approved right of way plans are received and acquisition is to begin.

- Utilizing approved right of way plans provided by district design, prepare a Right of Way Cost Estimate Worksheet (Form 3.3.3A) and Right of Way Cost Estimate Transmittal (Form 3.3.3C). In the Right of Way Cost Estimate Transmittal provide explanation for any change in the cost estimate conclusion from the previous estimate. At this stage Right of Way Section shall be provided a copy of the Right of Way Cost Estimate Transmittal (Form 3.3.3C).

236.3.3.3 Preparation of Right of Way Cost Estimate Forms

Each right of way cost estimate shall be developed by use of the Right of Way Cost Estimate Worksheet (Form 3.3.3A) or an appropriately supported estimate memo if an overall comparative unit cost method is used, in accordance with the following instructions. Each district shall maintain records sufficient to document all estimated costs. A list of improvements anticipated to be affected is to be retained in each file. Other required documentation will include rates or indicators resulting from an analysis of previous projects, market information, assessor's records, statistical reports, and cost manual information along with reasons for selection of specific data and calculations used to reach conclusions. Abstracted costs may be adjusted to fit circumstances, with the requirement that all such adjustments be explained.

A. Preparation of Right of Way Cost Estimate Worksheet

- 1. Land, Improvements, Property Rights and Damages

- a. Land

- Land use may be as general as agricultural, residential, commercial, industrial or as specific as available project scope information allows. Right of way areas to be acquired shall be provided by district design. Estimated unit values must be supported by reference to market information such as confirmed sales, listings or documented discussions with realtors, lenders or other real estate professionals, or by historic acquisition data.

- b. Improvements

- This cost may be estimated by itemizing improvements that are expected to be acquired and estimating the value of each. Alternately, the total number of improvements at an average unit value may be used. A list of affected improvements shall be attached to the worksheet. If individual improvement values are estimated they shall appear on the improvement list. Estimated values shall be supported by reference to sales, listings, or documented discussions with realtors, lenders or other real estate professionals. Other acceptable sources of support include cost manuals with citation of section, page number and revision date, reference to assessors' records and historic acquisition data. To arrive at improvement value, supported land value must be deducted from the dollar value of improved sales, listings or acquired properties.

- Fence to be acquired may be estimated as a lump sum for the project, or on a parcel basis. Acceptable support for fence cost includes reference to a fence cost schedule, bid or contract, or to a cost manual citing section, page number, revision date or other identifying information.

- c. Property Rights and Damages

- Values of access rights, easements and consequential damages may be calculated as a percentage of the Subtotal of Land and Improvement Value as estimated above. An overall percentage for the project may be used if the estimate is being made without right of way plans. This percentage may be derived by analysis of Review of Appraisals and Approval of Just Compensation (Form 6.4.3) or right of way parcel acquisition forms of a similar completed job as follows:

- Total the amounts in the Total Land and Major Improvements field of all Form 6.4.3s or the Land and Improvement Amount of the Right of Way Parcel Acquisition Parcel forms for all parcels of a given project.

- Total the amounts in the Damages to Remainder field of all Form 6.4.3s or Right of Way Parcel Acquisition Parcel forms.

- Divide total damages to remainder by total land and improvement amount.

- After right of way plans are available, effects to individual parcels may be considered and supported by reference to costs of specific acquired parcels.

- 2. Administrative Settlements

- The district experience in administrative settlements is the total of settlement amounts above approved offers, including administrative settlements for heritage and homestead payments for a given year divided by the total of approved offers for the same period, expressed as a percentage. This percentage may then be applied to the sum of paragraphs (a), (b) and (c) above to arrive at the total administrative settlement amount for the project being estimated.

- Alternately, the percentage of administrative settlement dollars above the total approved amounts for a given comparable project may be applied to the sum of paragraphs (a), (b) and (c) above.

- Data sources must be cited and calculations shown.

- 3. Condemnation

- This is the amount by which project costs may be expected to increase as a result of condemnation. Condemnation history must be analyzed on a per-project basis. Divide the amount by which commissioners' awards and legal settlements exceed approved offers for condemned parcels by the total of approved offers for a cleared project to produce the percentage by which condemnation may be expected to increase acquisition cost. This percentage must be applied to the sum of paragraphs (a), (b) and (c) above.

- Projects selected for comparison to the project being estimated should be the most similar available, preferably in the same court jurisdiction.

- 4. Relocation Assistance

- This is the estimated cost of all anticipated relocation assistance payments. Relocation costs may be estimated by comparison of the subject project to a previous project which had similar relocation elements, with the average payment per relocation parcel for the completed project multiplied by the anticipated number of relocation parcels on the project being estimated. Care should be used in selecting the project for comparison. In later project stages relocation cost may be estimated on a per parcel basis with support. Alternately, a typical or average relocation cost for elements like residential, business, etc. may be developed and applied.

- Additional support data is available in the Annual Relocation Statistical Report (Uniform Act Report) described in EPG 236.8.6.6.

- 5. Incidentals Costs

- Incidental costs may be estimated by multiplying the subtotal of the costs estimated in Paragraphs (1) through (5) above by the annual percentage for the district as shown on the Summary, Percent of Incidental Expenditures to Total Dollars Expended in the Right of Way Section Annual Statistical Report.

- Incidental cost may also be expressed as a cost per parcel, derived from completed projects exhibiting similar characteristics in terms of location, number of parcels and complexity. The comparable project must be cited along with calculations of the historic incidental cost per parcel.

B. Preparation and Filing of the Right of Way Cost Estimate Transmittal

Submit the Right of Way Cost Estimate Transmittal (Form 3.3.3C) to the district design engineer and the transportation project manager. Current and historic right of way worksheets and supporting documentation may be maintained with a central project file within district design or in a separate right of way project file. A matching Form 3.3.3C should be maintained in the central project file and the right of way project file, regardless if the files are physically combined or separate.

236.3.4 Right of Way Acquisition Authority and Project Funding

236.3.4.1 General

The following procedures for requesting authority for right of way acquisition activities and funding shall be used for state and federally funded right of way projects.

Prior to submitting a request for acquisition authority, the transportation project manager (TPM) must verify funds are available in the current fiscal year. The district right of way manager or designee in cooperation with the TPM should determine whether state funds only or federal participation will be requested in the right of way phase of the project. The district right of way manager must ensure proper documentation is received before an acquisition date (“A” date) is requested. Of particular importance are the easement needs of utilities located on the proposed improvement (see EPG 643.2.1.5 Right of Way).

The transportation project manager must verify all environmental classifications and cultural resource (EPG 127.2 Historic Preservation and Cultural Resources) approvals are complete.

236.3.4.2 Limited Acquisition Authority and Project Funding

The transportation project manager (TPM) must verify that the right of way plans have been approved, funding is available in the current fiscal year, environmental classifications and historic preservation approvals have all been secured prior to submitting an Acquisition Authority Date, A-Date (Form 3.4.2).

Limited acquisition authority may be requested when it is necessary to begin making charges to the right of way phase of the project.

Limited acquisition authority provides for all right of way activities up to and including appraisals. Also, acquisition and relocation activities may proceed on parcels identified as total acquisitions. This authority shall be provided prior to incurring right of way charges to the project.

Preliminary costs, such as, title information and preparation of cost estimates, etc., necessary for program and plan development shall be charged to the preliminary engineering phase of the project. For this reason, limited acquisition authority is not required for all projects.

A. The following procedure is to be used only when requesting federal participation in right of way acquisition and limited acquisition authority is being issued.

- The transportation project manager will submit an Acquisition Authority Date (Form 3.4.2) to Right of Way Section, together with a set of plans or plats of the total acquisitions. All information on the form must be complete.

- Right of way activity may not commence until the transportation project manager receives a copy of FHWA's approval from Financial Services/Right of Way Section.

- The Right of Way Section will review the Limited Acquisition Authority request and once approved will coordinate with Financial Services to set up the project and FMS project number. Limited acquisition authority may be issued more than one time on a job. In this event, fill in funds authorized for total acquisitions this request and total funds authorized to date, which is an accumulation of funds authorized. Incidental costs should not be included. A-Dates are to be parcel specific, therefore each request should list the parcels individually. Complete the appropriate box at the bottom of the form for Controller’s information.

B. The following procedure is to be used only when right of way is to be acquired with state funds and limited acquisition authority is being issued.

- The transportation project manager shall provide Form 236.3.4.2 to district right of way with a copy to the Right of Way Section.

- The preferred method for transmittal to the Right of Way Section is via email to the Right of Way Director with all required information attached.

- The Right of Way Section will review the Limited Acquisition Authority request and once approved will coordinate with Financial Services to set up the project and FMS project number. A set of plans or plats of the total acquisitions should be attached to the copy sent to the Right of Way Section. Limited acquisition authority may be issued more than one time on a job. In this event, fill in funds authorized for total acquisitions this request and total funds authorized to date, which is an accumulation of funds authorized. Incidental Costs should not be included. A-Dates are to be parcel specific, therefore each request should list the parcels individually. Complete the appropriate box at the bottom of the form for Financial Service’s information.

236.3.4.3 Acquisition Authority and Project Funding

The transportation project manager (TPM) must verify that right of way plans have been approved, funding is available in the current fiscal year, environmental classifications and historic preservation approvals have all been secured prior to submitting an Acquisition Authority Date (A-Date).

Acquisition authority on a project may be authorized when the total project or a portion of a project is being funded. Acquisition authority includes all phases of right of way activity.

A. The following procedure is to be used only when requesting federal participation in right of way acquisition:

- A request for acquisition authority and project funding shall be submitted on Form 236.3.4.2 (Acquisition Authority Date) by the transportation project manager to Right of Way Section, for coordination of federal funds. All information on the form must be completed, with a set of approved right of way plans or plats of the total acquisitions.

- Right of way activity may not commence until the transportation project manager receives a copy of FHWA's approval from the Right of Way Section.

- The Right of Way Section will review the Acquisition Authority (A-Date) request and once approved will coordinate with Financial Services to set up the project and FMS project number. A set of approved right of way plans should be attached to the copy sent to Right of Way Section. Acquisition authority may be issued more than one time on a job. In this event, fill in funds authorized this request and total funds authorized to date, which is an accumulation of funds authorized including funds authorized for Limited Acquisition Authority. Incidental costs should not be included. A-Dates are to be parcel specific, therefore each request should list the parcels individually. Complete the appropriate box at the bottom of the form for Financial Services’ information. The funds authorized cannot exceed the amount programmed for right of way acquisition on the project in the current fiscal year.

B. The following procedure is to be used only when right of way is to be acquired with state funds:

- The transportation project manager shall provide Form 236.3.4.2 to district right of way with a copy to Right of Way Section.

- The preferred method for transmittal to the Right of Way Section is via email to the RWPayments e-mail group with all required information attached.

- The Right of Way Section will review the Acquisition Authority (A-Date) request and once approved will submit the request to Financial Services to set up the project and FMS project number. A set of approved right of way plans should be attached to the copy sent to Right of Way Section. Acquisition authority may be issued more than one time on a job. In this event, fill in funds authorized this request and total funds authorized to date, which is an accumulation of funds authorized including funds authorized for Limited Acquisition Authority. Incidental costs should not be included. A-Dates are to be parcel specific, therefore each request should list the parcels individually. Complete the appropriate box at the bottom of the form for Financial Services’ information. The funds authorized cannot exceed the amount programmed for right of way acquisition on the project for the current fiscal year.

236.3.4.4 Advance Acquisition - Hardship and Protective Buying

In extraordinary cases or emergency situations, consideration may be given to acquisition of hardship or protective buying parcels within the limits of a proposed highway corridor prior to completion of processing of the final environmental impact statement or adoption of the appropriate environmental document, but only after:

- MoDOT has given official notice to the public that a particular location has been selected to be the preferred or recommended alignment for a proposed highway, or;

- a public hearing has been held or an opportunity for such hearing has been afforded.

Proper documentation shall be submitted to show that the acquisition is in the public interest and is necessary to:

- hardship - alleviate particular hardship to a property owner in contrast to others. (See guidelines in EPG 236.3.4.5)

- protective buying - prevent imminent development which would tend to limit the choice of highway location alternates. (See guidelines in EPG 236.3.4.5)

The transportation project manager will issue acquisition authority only after the Right of Way Section has approved the hardship or protective purchase status of a parcel.

Requests for hardship or protective buying on federally funded projects will not be considered on parcels located within 4(f) land or historical properties until the required Section 4(f) determination and the procedures of the Advisory Council on Historical Preservation are completed.

Acquisition of hardship or protective buying parcels shall not influence the environmental assessment of a project including the decision relative to the need to construct the project or the selection of a specific location.

Ultimate federal participation in the cost of hardship or protective buying parcels is dependent upon the incorporation of such property in the final highway right of way. When a parcel is partially incorporated in the right of way, federal funds will not participate in the remainder whether acquired as an uneconomic remnant or excess property.

Should a decision be made to acquire hardship or protective-buying parcels with state funds prior to Federal Highway Administration program approval on federally funded projects, such acquisition will not jeopardize federal participation in subsequent project costs. However, said acquisition must be in compliance with the provisions of Title VI of the Civil Rights Act of 1964 and the Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970 as amended.

Follow the limited acquisition authority process previously outlined.

236.3.4.5 Guideline for Determination of Hardship

The following is a guideline for determining hardship status:

- the property owner must request early acquisition and state the basis of the hardship request in writing;

- the basis of determination of hardship will generally fall into the areas of physical and/or economic problems;

- physical problems - age, health, disability and/or other extraordinary conditions that pose a threat to the health, safety and/or welfare of the owner-occupant or a member of his/her household for whom he/she is responsible; or

- economic problems - wide range of financial disadvantages or maladjustments, personal financial losses that are beyond the relocatee's capability to resolve.

236.3.4.6 Request for Hardship Acquisition

The district right of way manager shall investigate each application for hardship acquisition and request concurrence in the hardship from the Right of Way Section for those requests that they determine have sufficient documentation to qualify as a hardship.

236.3.4.7 Contents of Request

The written request to the Right of Way Section shall contain a statement pertaining to the current status of the project involved and the district right of way manager's recommendation for early acquisition and why it would be in the public’s best interest.

The following data must be attached to the request:

- a copy of the property owner's written request and documented proof of his/her need to sell the property and the inability to do so, due to the proposed highway location;

- any pertinent documentation to support the determination of hardship; such as, financial statements, doctor's statement in regard to health or disability, documented proof of transfer of employment or loss of employment, etc.;

- one copy of a plan sheet or strip map depicting the parcel in relation to the proposed highway corridor;

- an estimate of the cost of acquisition and relocation assistance of the parcel;

- the job number and terminus, year presently programmed for acquisition and construction;

- a statement pertaining to the present status of the project;

- a certification from the project manager that the acquisition will not influence the environmental assessment of the project including the "no build" alternative.

236.3.4.8 Request for Concurrence in Protective Buying Parcels

All requests to the Right of Way Section for protective acquisition should document that prompt acquisition is required to prevent development of property that could cause higher acquisition and construction costs and relocation of people and businesses, if deferred. Any requests for protective buying should be reviewed and approved by the district Corridor Preservation Committee, or if one does not exist in your district, approval by appropriate district management prior to submittal to Right of Way Section.

236.3.4.9 Contents of Request

Each request should include the written request for protective acquisition including, but not limited to, the following information:

- name of present owner and location of property;

- area of parcel proposed for acquisition and description of remainders, if any;

- the district's estimate of the probability of development as proposed by the owner or developer and a protective savings estimate to demonstrate that increase cost may tend to limit the choice of highway alternatives;

- one copy of a plan sheet with the area involved depicted in relation to the proposed highway corridor;

- the job number and terminus, year presently programmed for acquisition and construction;

- a statement pertaining to the present status of the project;

- a certification from the project manager that the acquisition will not influence the environmental assessment of the project including the "no build" alternative.

236.3.4.10 Hardship and Protective Approval

The Right of Way Section will coordinate with the FHWA in obtaining concurrence in the approval for hardship and protective buying on projects with federal participation in right of way. Do not proceed with acquisition of any hardship or protective purchase parcels until written concurrence is received from the Right of Way Section.

Upon approval from the Right of Way Section for a hardship or protective buying parcel, every effort should be made to appraise and acquire the property with a minimum of delay and consistent with normal acquisition procedures. A categorical exclusion determination (CE) must be completed in accordance with instructions in EPG 236.3.1.2. If the parcel has been included in a RES (Request for Environmental Services) a CE will not be required.

Past experience has shown that hardship and protective purchases have not resulted in significant environmental effects and that this experience has resulted in categorical exclusions being granted by FHWA in accordance with 23 CFR 771.117(d)(12). MoDOT was granted approval by FHWA on June 9, 1994, for programmatic categorical exclusion for these purchases in accordance with 23 CFR 771.117(e). The result of this is that we will not need to request concurrence from FHWA in categorical exclusions for future hardship and protective purchases.

236.3.4.11 Condemning Hardship and Protective Buying Parcels

Should negotiations for a hardship or protective buying parcel fail, condemnation action in compliance with the Uniform Act will be instituted insofar as permitted by Missouri state law. Section 227.050, RSMo, requires the Chief Engineer to submit to the Commission in writing the Chief Engineer's recommendations as to detail plans with the right of way and surfaced roadway and type and character of construction for the highway. The statute provides that the Commission may approve, disapprove or modify the plans and proposals as recommended and the action of the Commission will not be disturbed except by subsequent action of the Commission. Supreme Court Rule 86.04 requires that when a condemnation petition is filed for the acquisition of right of way for a highway improvement, the detail plans required by Section 227.050, RSMo, shall be filed with the Circuit Clerk. This is necessary in order to confer jurisdiction on the court. Because of this, the department in many instances would not be in a position to institute condemnation proceedings immediately for the acquisition of hardship cases. In most instances, if the project has progressed to a point that detail plans can be approved by the Commission and filed with the court, the department is at a point of normal right of way acquisition. See EPG 236.13.14.2 Right of Way Obtained by Condemnation for additional information.

236.3.4.12 Condemnation Action on Hardship and Protective Buying

Prior to instituting condemnation of a hardship or protective buying parcel, the district right of way manager shall discuss with regional counsel and the Right of Way Section to determine if plans are adequate to allow for condemnation to proceed and to review offer data that is pertinent to the parcel.

236.3.4.13 Acquisition of Property from an Employee or a Commissioner of MHTC

If all or any portion of an employee’s or commissioner’s property is needed for a project the following process must be followed.

An employee or commissioner-owned property is defined as any property or property interest held by an employee or commissioner wherein the individual will directly receive financial gain from the acquisition transaction. Instances where the individual is merely a corporate officer, or the interest to acquire is deed of trust held by a financial institution owned or directed by the employee or commissioner, may be handled as a normal acquisition. Should you be made aware of a situation of an owner that is an immediate relative of an employee or commissioner, the Right of Way Section will advise if the acquisition requires application of this policy.

Employee Acquisition

A summary of pertinent details (right of way plan sheet, facts about the employee, copy of scope of assignment (i.e. Fee Study), and other related facts) about any proposed acquisition of employee-owned property or property rights must be submitted to the Right of Way Section for the Right of Way Director’s approval prior to proceeding. Should the acquisition appear to be of a routine nature with no apparent significant conflict, the Right of Way Director will recommend the policy listed below for employees and employees need not be encouraged to go to condemnation.

Acquisitions, which have been determined to be $10,000 or less, may be valued by MoDOT staff and may be reviewed and just compensation approved by the Right of Way Manager or certified appraiser . The Right of Way Section will secure administrative review of all valuations with values less than $10,000 from the Federal Highway Administration prior to an offer being made. Commission approval is not necessary to extend the approved offer to the employee.

Acquisitions of more than $10,000 will have a fee appraiser or appraisers determine compensation. The appraisal will be reviewed and just compensation approved by the Right of Way Manager and a certified appraiser. The Right of Way Section will secure administrative review of all appraisals with values greater than $10,000 from the Federal Highway Administration prior to an offer being made. Commission approval is not necessary to extend the approved offer to the employee.

The approved offer will then be extended to the employee and if the offer is for $10,000 or less, they can accept the approved offer. Any administrative settlement requires approval by the Director of Right of Way.

If the offer is for more than $10,000, the employee can accept the approved offer. Any administrative settlement requires approval by the Assistant Chief Engineer, Assistant Chief Counsel - Project Development and Director of Right of Way.

The offer to mediate needs to be extended to employees. The MoDOT representative at the mediation session should be from the Right of Way Section or another district right of way office.

Should the acquisition appear too controversial or cause conflict, the Right of Way Director will advise the district to proceed with the policy listed above with the added provision the employee should be encouraged to go to condemnation.

Prior to condemnation of an employee, submit the appraisal, negotiator’s report, and other pertinent information to the Right of Way Section. The Assistant Chief Engineer, Assistant Chief Counsel - Project Development and Director of Right of Way will determine if a settlement or condemnation will be used.

Commissioner Acquisition

The following conflict of interest policy must be followed for any acquisition from a commissioner of the Missouri Highways and Transportation Commission (MHTC).

Real property acquisition procedure

When a member has any possessory interest in real property for which an offer of just compensation will be made so that it may be acquired by MHTC for a project, the following procedure should be used by the commission member and shall be followed by MoDOT staff and special conflicts counsel.

Fee appraisal(s)

The district will have a preliminary estimate of damages in a fee study. If in the fee study, the apparent compensation is estimated to be $500 or more, the district’s right of way unit will have one or more fee appraiser(s) determine just compensation for the property to be acquired and the damage, if any, to the property’s remainder. If the apparent compensation in the fee study is less than $500, the appraisal will be prepared by district staff appraiser(s) and approved by the right of way manager.

FHWA review and approval

The Right of Way Director will also secure review and approval of the appraisal(s) and the approved offer of just compensation from the Federal Highway Administration.

MHTC review and approval

When the approved offer exceeds $500, Section 105.454 (2), (3) RSMo. requires public notice before the sale of real property. Therefore, the Right of Way Director shall place the matter on MHTC’s open session meeting agenda for the Commission to review and finally approve the offer of just compensation (with the affected member abstaining from discussion and voting) prior to the offer being made to the commission member. To provide adequate public notice, the agenda item shall be styled: “Purchase of Real Property Interest from Commissioner _________.” However, if the approved offer does not exceed $500, MHTC review and approval is unnecessary.

Offer of just compensation to MHTC member

The approved offer will then be made by the district’s right of way office to the member, or his/her authorized representative. However, the member will be encouraged to refuse the offer and go through condemnation (to avoid any appearance of impropriety or undue influence by the member over the staff or other MHTC members) if the offer is more than $10,000. Provided further; however, if the offer is $10,000 or less, the member need not be encouraged to go through condemnation and may execute a deed for the real property in exchange for the approved offer.

Condemnation

If the MHTC member agrees to the condemnation, the parcel will be condemned at the first opportunity by special conflicts counsel approved by MHTC (with the affected member abstaining from discussion and voting).

Settlement

Once the condemnation commissioners appointed by the circuit court have set a value for the property, if that value is acceptable to all parties, a proposed settlement in the amount of the condemnation commissioners’ award should be presented to the court for its review, approval, and entry of judgment, but the court shall be requested by special conflicts counsel to delay its action until after the members’ term ends (to avoid any appearance of impropriety or undue influence by the member over the staff or other MHTC members).

Jury trial

Should either party not agree with the value established by the condemnation commissioners and file exceptions to the condemnation commissioners award, the special conflicts counsel should prepare the case for trial, but shall request the circuit court to delay the jury trial until after the commission members’ term expires (to avoid any appearance of impropriety or undue influence by the member over the staff or other MHTC members). The final price for the property will be that determined by jury verdict and the court’s final judgment after appeal, if any.

Rule 17

Should the circuit court refuse under section (2) (I) 8. or 9. above to delay the action under Missouri Supreme Court Administrative Rule 17, the special conflicts counsel shall consult with MHTC in closed meeting regarding the appropriate course of action (with the affected member being excluded from the meeting).

236.3.5 Right of Way Expenditures

236.3.5.1 General

The proper accounting and recording of all expenditures and income occurring as a result of right of way transactions are the responsibility of the Financial Services Division. In order for the Financial Services Division to carry out its responsibility, it is necessary for the district right of way office and the Right of Way Section to cooperate by supplying and interpreting essential information needed for accurate cost accounting.

Although the Financial Services Division is responsible for recording all expenditures and income as a result of right of way transactions, it will be necessary for each district right of way office to maintain such additional record keeping as is necessary to furnish the required managerial reports and statistical data requests. These additional records may be maintained at each district's discretion so long as they are sufficient to furnish the needed information.

Refer to the SAM II Chart of Accounts for coding instructions on right of way transactions.

The following sections will describe right of way policy and procedure in regard to expenditure authorization and control.

236.3.5.2 Expenditure Accounting

Financial Services Division establishes one or more unique accounting number(s) for each right of way project when an A-Date is issued. This accounting number is termed the SAM II Project Number. The SAM II Project Number is available to district and division users by querying the SAM II system, and is also maintained on the Job List in RWPA.

The district right of way office will forward, along with the correct accounting coding, all required documentation and data for right of way payrolls and relocation claims (payments) to the Right of Way Section. Documentation required for processing payment for land acquisition by negotiation shall include a certified escrow agreement or certified sales contract, Form 238.2.17 Professional Land Surveyor Description Review Form, and a right of way Acquisition Payment (Form (A-419) for each parcel. If an administrative settlement is reached the administrative settlement memorandum is a required attachment. In order for a check to be issued or electronic funds transfer to occur the payee must have a vendor number. This vendor number can be obtained by filling out the Vendor Input/ACH-EFT Application Form provided by the Office of Administration (OA) and submitting that form to OA. The payee's vendor number is to be included on the Acquisition Payment (Form A-419).

The payroll packet may be submitted through inter-office mail or by emailing scanned “pdf” files. All required documentation is still required.

Once the Right of Way Section reviews and approves the payment the Right of Way Section will submit the payroll to the Financial Services Division.

Commission approval must be obtained prior to payment of land acquisition for maintenance sites, resident engineers' offices and district office sites.

Expenditures for incidental expenses such as commercial invoices, time charges, equipment rental, subsistence expenses, pro rata tax, prepayment mortgage penalty payments and bill of cost shall be forwarded to the Right of Way Section for review and delivered to Financial Services Division, Accounts Payable Section.

Checks in payment of right of way regular land purchases, commissioner’s awards, final judgments and relocation assistance payments are forwarded to the district for delivery to the payee.

Accounting for Easements and Payroll Coding Changes

As part of the accountability statute, MoDOT is required to prepare a comprehensive financial report to be audited by an independent certified public accountant. The financial report must conform to generally accepted government accounting principles. Since fiscal year 1998, MoDOT has prepared yearly financial reports and each has been audited by independent certified public accountants. This financial report is included in the yearly accountability report presented to the legislature in November.

In addition, as required by the bond covenants, this yearly audited financial report is submitted for continued disclosure requirements associated with the bonds issued by the department. The results of the yearly audit continue to assist in issuing bonds at low interest rates.

To comply with generally accepted government accounting principles, MoDOT must follow all standards issued by the Governmental Accounting Standards Board (GASB). The GASB is continually issuing standards to establish accounting and financial reporting requirements to reduce inconsistencies and increase comparability among state and local governments.

GASB statement 51, accounting and financial reporting for intangible assets will be complied with by MoDOT. Intangible assets include permanent and temporary easements. Detail is needed when processing right of way payments and MoDOT must have the ability to report and track these permanent/temporary easements from the time of acquisition to disposition. This also includes non-cash acquisitions.

Accounting for Easements

Easements meeting the following two criteria are to be recorded with the appropriate fixed asset (FA) type.

- 1. They are MoDOT assets.

- 2. They are estimated to exist more than one year.

All easement acquisitions are estimated to exist more than one year for accounting purposes.

Permanent Easements and Utility Easements have their own Fixed Asset Type, while Temporary Easements will have a different Fixed Asset Type.

Financial Services will update the general ledger fixed asset account-Permanent Easements and Utility Easements (1705) or Temporary Easements (1707) at the time the payment is processed. To affect the general ledger accounts, district right of way will enter the appropriate Fixed Asset Type on the payroll document (A-419). The Fixed and Utility Asset Types are "P" for Permanent Easements and "O" for Temporary Easements. "Regular purchases" will continue to have a Fixed Asset Type of "R".

DONATIONS: Donations of any permanent easement or temporary easement must be accounted for in the database Right of Way Parcel Acquisition (RWPA) as usual. A value MUST be placed on these donations by individual easement type. While a full-blown valuation is not required, documentation of the estimated value(s) must be placed in each parcel file for audit purposes.

Once a month and prior to submittal of any reports on this information to Financial Services, Journal Vouchers (JV) will be requested by the Right of Way Section for newly documented donations of permanent or temporary easements.

RW Database (Subsidiary Ledger)

To facilitate reconciliation to Financial Services general ledger and to respond to internal, financial and state auditor questions, the Right of Way database RWPA contains detail related to all easements. The RWPA database is updated to include all necessary information and will be balanced against the general ledger.

Once a month Financial Services will be provided a report with applicable information for the prior month, year to date and inception to date.

Appraisal Guidance and Format Changes

Appraisal and waiver valuation formats account for individual allocation of easement values for use in documenting the individual easement payroll items. Appraisal Review and Approval of Just Compensation (Form 6.4.3) and Adjustment to Value or Just Compensation (Form 6.4.4) will reflect these individual easement items under Damage to Remainder.

The following provides additional information necessary for right of way to comply and meet the MoDOT needs in respect to these requirements.

Acquisition Payroll Form (A-419) includes a detailed breakdown of the payroll including lines for Permanent Easements and Temporary Easements.

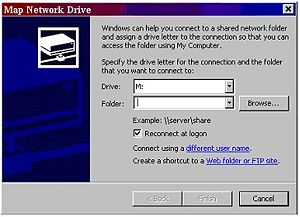

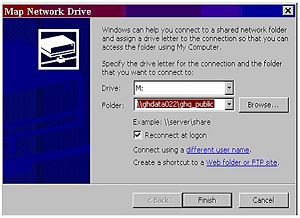

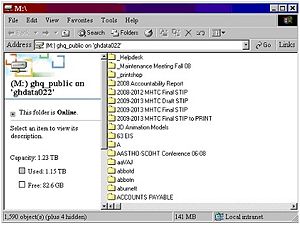

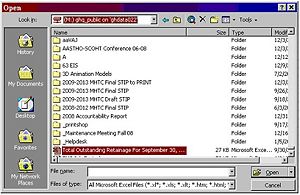

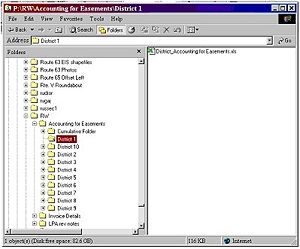

Also an Excel spreadsheet will be the interim subsidiary ledger for easements that contains all the information Financial Services needs. District right of way will need to maintain this spreadsheet beginning with payroll data on permanent and temporary easements payrolled January 1, 2009 and until such time as the RWPA database(s) can accommodate all the information necessary. The district spreadsheets are available on the Central Office Public Drive (directions for mapping to the p:drive are available, to the right).

Accounting for Easements - Additional Guidance

1. If a payroll involves splitting the payroll into multiple payees (which requires two separate A-419's) then the entry in the "accounting for easements" spreadsheet should also be "split" into the number of transactions with the appropriate value for the easement type broken out separately.

For example. An acquisition of a temporary easement valued at $700 in which two owners want to be payrolled 1/2 each would require two lines of entry on the "accounting for easements" spreadsheet one each for $350 dollars in value. The acreage would not need to be split but rather one would have the entire acreage and the other left blank. This will allow for the controller to enter two different SAM II transaction numbers and appropriate SAM II transaction dates on the spreadsheet.

2. If an easement type is valued at $0 DO NOT include it on the payroll document (A-419) and thus DO NOT attempt to code in the code block of the payroll form A-419 for the $0 value easement. However, it must still be documented on the spreadsheet as an easement acquired with $0 value. Financial Services will then need to review the quantity of $0 values to determine the materiality under the GASB Standards. This will be a moving target as we move forward but until a final determination is made we will comply with Financial Services's current request.

3. When documenting the permanent and temporary easements within the appraisal formats (allocation section) and the appraisal review forms remember to add all the various permanent easements together and temporary easements together and report only a single quantity and value for each type. These should then be documented the same way on the spreadsheet (with the exception of # 1 above when the payroll (value) is to be split between multiple payees).

For example. The acquisition consists of a permanent drainage easement, .10 acre, valued at $1,000 permanent utility easement, .50 acre, valued at $5,000 temporary easement, 1.0 acre, valued at $100. These would be payrolled/reported as permanent easement, .60 acre, at $6,000, fixed asset "P" and temporary easement, 1.0 acre, at $100, fixed asset "O".

NOTE: IT HAS BEEN NOTICED THAT RWPA DOES NOT ALWAYS MATCH WHAT IS BEING ENTERED ON THE SPREADSHEET FOR THE AREA “ACQUIRED”. THE TWO SHOULD EQUAL, UNDERSTANDING THAT RWPA ALLOWS FOR PERMANENT UTILITY EASEMENTS TO BE ENTERED SEPARATELY.

4. If there is a combination acquisition of permanent and temporary easements ONLY the fixed asset type for any administrative settlements/homestead/heritage amounts should have a fixed asset "P", again, only if there are NO "R" fixed asset payments included. If there are fixed asset "R" (regular purchase) coding, then the administrative settlements and/or homestead/heritage amounts would have a fixed asset "R".

If the acquisition is a permanent easement OR temporary easement ONLY, then any administrative settlement/homestead/heritage payments would be coded with a fixed asset "P" or "O" as appropriate, even if the easement had a value of $0 and was not included on the payroll (See # 2 above).

5. Access rights only acquisitions, including any administrative settlements or homestead/heritage payments associated with an access rights only acquisition, should be coded fixed asset "R".

236.3.5.3 Expenditure Controls

Right of way expenditures are controlled as follows.

(a) Acquisition authority ("A" Date) and funding authorizations from project manager. (Do not make expenditures for right of way acquisition or relocation payments until authority is received from the project manager.)

(b) Authorized funds shall not exceed Statewide Transportation Improvement Program (STIP) as of the date of authorization.

(c) Regular purchase right of way, uneconomic remnants, excess land and borrow acquisition payments shall not exceed amounts established by approved Form 6.4.3, Form 6.4.4, district-approved payment estimate (waiver valuation) form, or administrative settlement memo.

(d) Expenditures for acquisition by eminent domain shall not exceed the amounts as established by court-approved commissioners' report, court-approved jury settlement or stipulated legal settlement.

(e) All other incidental expenditures shall be controlled in accordance with approved contracts, agreements or special Commission minutes.

236.3.5.4 Expenditure Authorization (Commission)

The MHTC authorizes expenditures for right of way acquisition and relocation payments when it approves the 5-year STIP or through STIP amendments.

236.3.5.5 Authorization and Processing of Incidental Expenditures

Right of way expenditures; such as, pro rata tax, mortgage prepayment penalty, fee appraisal cost, title contract fees and other incidental expenditures will be paid by commercial invoice process as specified by the FMS Financial Policies and Procedures Manual.

Certain right of way expenses can be authorized and paid from the Design/Bridge Consultant (DBC) budget organization.

Eligible expenses are for payments to consultants under contract with MoDOT for Title Services, Real Estate Appraisals and Reviews, Mediation and Negotiation.

A copy of any contract to be funded by the DBC budget should be forwarded to the transportation project manager in the Design Division responsible for the DBC, and to Financial Services, Accounts Payable (Contractual Payments) at the Central Office prior to requesting payment on that contract. This provides the ability to track contracts for reporting to legislature.

Approved invoices with appropriate coding should be forwarded to Financial Services, Accounts Payable (Contractual Payments) at the Central Office for processing. The district right of way office has full responsibility for contract administration and must certify each invoice as being due and payable under the terms of the contract.

Coding will be the same as immediately prior to this change, except that the Org will be 2DBC instead of the district right of way org. (41X6, 42X6, 33X6, etc.) and the Appropriation will be 4403 instead of 4402. Specifically, coding will be as follows:

| Item | Appraisal/Review | Title (R-phase Project) | Title (P-phase Project) | Negotiation | Mediation |

|---|---|---|---|---|---|

| Fund | 0320 | 0320 | 0320 | 0320 | 0320 |

| Agency | 605 | 605 | 605 | 605 | 605 |

| Org. | 2DBC | 2DBC | 2DBC | 2DBC | 2DBC |

| Approp. | 4403 | 4403 | 4403 | 4403 | 4403 |

| Activity | R345 | R344 | R344 | R346 | R346 |

| Object | 2842 | 2820 | 2544 | 2845 | 2845 |

| Sub-Object | n/a | 09 | n/a | 01 | 02 |

Please note that the above coding provides a different object/sub-object for title work depending on whether the project is a “P-phase” or “R-phase”. This is because object 2820 requires a fixed asset and a fixed asset requires an R-phase project number. Charges to both objects are capitalized, but those to 2544 are capitalized later in the accounting process.

Annually a budget is prepared for the Design/Bridge Consultant org code with input from the districts. It will be necessary for each district right of way office to include its estimated funding requirement with the district submittal. This may be included as a component of the Design Division figure, or may be shown separately.

There will be no change to district operating funds allocations as a result of this change.

236.3.6 Federal - Aid to Local Public Agency

236.3.6.1 General

The Federal-Aid Program is funded with a portion of federal aid highway funds. These funds must be expended on improvements to certain designated public highways. The public highways that qualify for this program must qualify for federal aid and be under jurisdiction of and maintained by a public agency and open to public traffic.

The Bridge Program is funded with an established portion of the federal aid highway funds. These funds must be expended on improvements to a public road, street, or highway. The public roads that qualify for this program must be under the jurisdiction of and maintained by a public agency and be open to public traffic.

The right of way procedures for federal-aid projects must be in compliance with requirements 23 CFR and 49 CFR. A document entitled Local Public Agency Land Acquisition has been developed and is available to provide guidance to local agencies with regard to right of way acquisition.

236.3.6.2 Definitions

- Public Highway: Any alley, street, road or highway under the jurisdiction of and maintained by a public agency and open to public traffic.

- Public Agency: Any county, municipality, state or local political subdivision, or governmental agency. In the following subarticles of EPG 236.3, these public agencies will be referred to as "local agencies."

236.3.6.3 Responsibility for Right of Way Acquisition

The Missouri Department of Transportation has the overall responsibility for the acquisition of right of way on all federally assisted right of way projects in the state of Missouri.

It shall be the district's responsibility to review plans for compliance. (See Section V of the Local Public Agency Land Acquisition Manual.)

If the LPA is requesting federal aid in the right of way phase of a project the district right of way office shall review cost estimates for accuracy and reasonableness and submit the estimate to the Right of Way Section for acquisition authority. (See Appendix Item 2B of the Local Public Agency Land Acquisition Manual.)

If the LPA is not requesting federal aid in the right of way phase of a project the district shall provide a Notice to Proceed to the LPA rather than an A-Date.

Local agencies may acquire necessary right of way on projects within the political subdivision of their jurisdiction provided they are adequately staffed, equipped, and organized to provide such services to comply with requirements of 23 CFR and 49 CFR.

236.3.6.4 Informing the Local Agency of Its Responsibility in Acquiring Right of Way on Federally Assisted Highway Projects

It shall be the district's responsibility to fully inform the local agency of its responsibility to comply with the requirements of 23 CFR and 49 CFR when acquiring right of way in conjunction with a federally assisted highway project.

The local agency must be informed of these responsibilities prior to executing the supplemental project agreement and the agreement shall contain and set out the conditions of acquisition and funding for any necessary right of way.

236.3.6.5 Determination of Local Agency’s Capabilities to Assist in the Acquisition of Right of Way

The district shall make a determination whether the local agency is adequately staffed to perform the necessary right of way functions. It should also determine if it would be practical to maintain a staff to perform these functions. These determinations are reported on appendix item 2B of the LPA Land Acquisition when requesting acquisition authority.

If the local agency is not staffed adequately to perform all or any part of the right of way functions, contracting these functions is permitted. Contracting and contract documents are covered in Local Public Agency Land Acquisition.

When a local agency is not staffed to perform all or part of the right of way functions, it may request that the state perform all or part of these functions for the agency. The district should evaluate their program and schedule to determine if performance of this work would interfere with their own work. If approved by the district right of way office to provide this assistance, an agreement should be prepared between the agency and the state to provide these services and shall set out the conditions for reimbursement of the state's cost to provide the agreed services.

Local agencies must follow state procedures as contained in this manual and the LPA Manual or develop their own procedures that must comply with Titles 23 and 49 CFR. Such procedures must receive prior approval by MoDOT and FHWA.

236.3.6.6 Monitoring Local Agency in the Acquisition Function

When right of way for a local agency project is acquired by other than state forces, the district shall monitor all phases of the acquisition by the local agency or its contractor to assure compliance with 23 CFR and 49 CFR. Monitoring should begin early in any phase of right of way activities to assure compliance and to avoid potential nonparticipation.

The monitoring function also includes the condemnation phase if undertaken by the local agency. It is the district right of way office’s responsibility to notify the local agency that proper documentation must be made for not filing exceptions to awards, for justification for settlements, and for trial reports. The requirements for documentation are established in Local Public Agency Land Acquisition. The district right of way office shall obtain copies of all justifications and/or trial reports and furnish copies to the regional counsel for their review. Counsel's review will be furnished to the district right of way office for attachment to the project monitoring report. In case of inadequate documentation, counsel shall contact appropriate representative of local agency for corrective action.

236.3.6.7 Documentation of Monitoring Local Agency Projects

The district shall prepare a monitoring report of the local agency's performance or its contractor's performance for each phase of the right of way function. When it is determined that each phase of the right of way function is in sufficient compliance, the original monitoring report shall be retained in the district files with one copy forwarded to the division office along with the clearance certification. A copy of the monitoring report can be found in Local Public Agency Land Acquisition.

If the district determines that the local agency is not in sufficient compliance to qualify the project for federal aid, the district should work with the LPA to attempt to resolve the discrepancy. If the discrepancy cannot be resolved the district shall notify the Right of Way Section. When appropriate the Right of Way Section will confer with the Federal Highway Administration on the deficiency and notify the district of any further action necessary.

236.3.6.8 Programming Right of Way Projects

In order to receive federal participation, all projects including those involving acquisition of additional rights of way must be programmed with the Federal Highway Administration.

236.3.6.9 Acquisition Authority

Project authorization (acquisition authority) must be received from the Right of Way Section prior to incurring any expenditure for acquisition on projects where the department or local agency anticipates federal-aid participation. Before acquisition authority is issued, the district right of way office shall check for environmental classification approvals.

Therefore, MoDOT and local agency must decide if they desire federal participation in the right of way phase of a project prior to making appraisals, negotiations, and actual relocation assistance payments.

Acquisition authority should be requested from the Right of Way Section office by using the information contained in the Local Public Agency Land Acquisition. All information on said form shall be furnished along with any pertinent remarks to explain the planned right of way acquisition.

When department personnel are to acquire right of way for a local agency, it will be necessary to request authorization from the division office before proceeding with the work regardless of the funding on the project.

If the local agency is not requesting federal participation in right of way costs, the district can authorize the local agency to begin acquiring or getting donations by approving the agencies submittal as outlined in the Local Public Agency Land Acquisition. This action would follow the district's review of plans and a check on the approval of the environmental classification.

236.3.6.10 Obligation of Funds

Concurrent with project authorization, funds must be obligated for the total estimated cost of the work being authorized. If actual costs for authorized work exceed estimated costs, the district right of way office must submit a request for a modified project agreement to the Right of Way Section.

236.3.6.11 Clearance Certification

A clearance certification as set out in EPG 236.18.10 Local Public Agency Land Acquisition shall be submitted to the division office when the local agency or department personnel have acquired all necessary right of way for a project.

Unless state forces acquire the right of way, the local agency shall submit to the district the required statements of certification on their letterhead, and signed by appropriate official or officials as outlined in EPG 236.18.10 Local Public Agency Land Acquisition. The district submits this certification along with their monitoring report indicating the acquisition qualifies for federal participation to the Right of Way Section.

236.3.7 Right of Way Clearance Certification

236.3.7.1 General