236.6 Appraisal and Appraisal Review

- Adjustment of Value or Just Compensation (Form 6.4.4)

- Application for Employment as Contract Appraiser (Form 6.5.3)

- Appraisal Review and Approval of Just Compensation (Form 6.4.3)

- Assumptions and Limiting Conditions (Form 6.3.1A)

- Certificate of Appraiser (Form 6.3.1B)

- Comparable Lease (Form 6.3.5C)

- Fee Appraiser Performance Evaluation (Form 6.5.13)

- Nonresidential Sale (Form 6.3.5A)

- Realty Asset Estimate Greater Than $25,000 (Form 6.3.7C)

- Realty Asset Estimate Less Than $25,000 (Form 6.3.7B)

- Renewal Application for Employment as Contract Appraiser (Form 6.5.3a)

- Residential Sale (Form 6.3.5B)

- Roster of Approved Contract Appraisers

- RWPA checklist

- Scope of Assignment (Form 6.2.2)

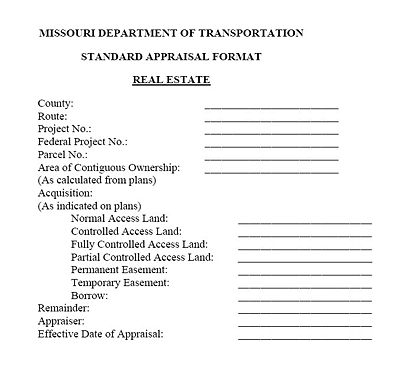

- Standard Appraisal Format (Form 6.3.1)

- Summary Value of Tenant Interests (Form 6.3.1C)

- Uniform Residential Appraisal Report and Addendum (URAR) (Form 6.3.4)

- Value Finding Appraisal Format (Form 6.3.2)

- Value for Realty Asset Inventory (Form 6.3.7A)

- Waiver Valuation - Payment Estimate (Form 6.3.3)

- Forms RW16 and RW17 are accessible in eAgreements.

236.6.1 Overall Operating Policies

236.6.1.1 Appraisal Reports Required

| Appraisal Format | Maximum Value for Format | Certified Appraiser Required to Complete | Appraisal Review Required | Type of Acquisitions/Impacts |

|---|---|---|---|---|

| Standard | Any Value | Yes - notify property owner to accompany, certification required | Yes | Complex, improvements and/or relocation involved. Change in highest and best use after the acquisition. |

| Value Finding | Any Value | Yes - notify property owner to accompany, certification required | Yes | Simple, no major improvements are to be acquired. |

| Waiver & Payment Estimate | Cannot exceed $35K - excluding fencing | No | No | Simple, nominal access rights. |

| Nominal Acquisition Payment (NAP) | Requires Asst. to State Design Engineer-ROW approval to use. | No | No | Simple and typically used for small temporary easements. |

It shall be the policy of The Missouri Department of Transportation (MoDOT) to secure at least one appraisal of each fee hold which is sought, or from which is sought certain realty rights having an estimated value that exceeds $35,000. Said appraisals shall be prepared on approved formats and comply with accepted appraisal practices.

Non-complex valuations of acquisitions of less than $35,000 shall be prepared on a Payment Estimate, (Form 236.6.3.3) or other Waiver Valuation document that has been approved by Right of Way Section, Waiver Valuations, including Payment Estimate are not considered an appraisal.

An exception to this policy shall include lands or rights owned by the United States of America or any other entity where the owners thereof are willing to donate necessary rights or parts thereof subsequent to being informed of MoDOT's policy with regard to appraisals and grantors' rights to receive just compensation.

District right of way management may assign additional appraisal reports by the same staff or fee appraiser that prepared an initial appraisal report (i.e. changed conditions, time, different format for condemnation, etc.) or assign an additional appraisal report to a different appraiser. Additional appraisal reports by two appraisers for the same time and conditions should only be assigned when the complexity of the acquisition already necessitates a Standard Format appraisal and should only be assigned under the most complex and high value situations. Complexity and relative high value varies by location, available data, unique nature or property type, extent of property impact, etc. A second appraisal of the same conditions and effective date might be considered when an initial appraisal submittal is found to be inadequate or inappropriate, as determined by district right of way management. Additional appraisal reports by the same or different appraiser may be considered prior to condemnation action, as determined by district right of way management.

A specialty appraisal shall be secured when affecting or acquiring all or a part of equipment, trade fixtures, or specialty items and the evaluation thereof is beyond the expertise of realty appraiser(s), as indicated by the Scope of Assignment, (Form 236.6.2.2).

- A. Valuation Reports Provided to Owner and Tenant

- MoDOT adopted policy January 1, 2004 to provide valuation reports to owners at the initiation of negotiation (EPG 236.7 Negotiation).

- Chapter 523 RSMo requires "(1) Any condemning authority shall, at the time of the offer, provide the property owner with an appraisal or an explanation with supporting financial data for its determinations of the value of the property for purposes of the offer made in subsection 1 of this section. (2) Any appraisal referred to in this section shall be made by a state-licensed or state-certified appraiser using generally accepted appraisal practices."

- The above licensing and certification requirement is satisfied by the co-signature of a certified person on Waiver Valuations and review by a certified person on value finding and standard appraisals.

- B. Guidelines for Valuation Reports Provided to Owner and Tenant

- Approved appraisal report or Payment Estimate/Waiver Valuations will be provided to owners, with all analysis and adjustment grids, exhibits, certificates, etc.

- Reviewers should not remove any material, approach, conclusion, exhibit, etc. from reports without the cooperation and consent of the appraiser.

- When a reviewer is required to reconcile between two MoDOT-authorized appraisals, district management shall make a determination of what report(s) and other supporting rationale are to be provided to the owner. Each report shall contain its own sale data, with only location, size, price and other comparative data being included.

- If Sale Data Sheets are provided to owners, it will necessitate that the appraiser using the form will be fully responsible for the content of sale forms written by others.

- Confidentially confirmed sale information cannot be included in appraisals provided to owners. If there is no substitute for the use of confidential information, the method of its use must be addressed by the district on a case-by-case basis. The information may only be useable as backup or support in the appraiser’s file, rather than in the report.

- When tenant owned improvements, fixtures or personalty are acquired or affected by the acquisition, the district should prepare and provide a Summary Value of Tenant Interests (Form 236.6.3.1.C), to the tenant.

- C. Review Forms to Right of Way Section

- Copies of appraisals shall be maintained in the district according to document retention schedule and are not sent to Right of Way Section. A copy of Appraisal Review and Approval of Just Compensation (Form 236.6.4.3) and Adjustment Of Value Or Just Compensation (Form 236.6.4.4) shall continue to be sent to Right of Way Section.

- D - RWPA system requirements for Appraisals and Improvements

The approved appraisal must be uploaded in eProjects under the applicable project and parcel. All data must be entered in RWPA on the Appraisal List screen: Type (Appraisal, Revision, Review), Format, Date, Appraised Amount and Approved Amount.

If there are any improvements on the property, the Type of Improvement (Residential, Commercial, Agricultural, Industrial or Other) must be entered on the Improvements screen in RWPA.

236.6.1.2 Certification and Appraisal Assignment

All fee appraisal work performed for MoDOT for realty acquisition, shall be by contractual agreement with certified appraisers from the Roster of Approved Contract Appraisers.

Any right of way personnel that have a Residential or General Certification are authorized to prepare appraisal reports and Waiver Valuations. The district right of way manager may authorize non-certified senior, intermediate and right of way specialists to prepare and sign Waiver Valuations. The Right of Way Section may authorize non-certified senior, intermediate and right of way specialists to prepare and sign Value Finding, Standard Format and URAR appraisal reports.

Waiver valuations shall be prepared or cosigned by certified personnel. Value Finding, Standard Format and URAR appraisal reports prepared by non-certified personnel will be reviewed by, and just compensation approved by certified personnel.

236.6.1.3 Moonlighting

The practice of right of way personnel holding additional jobs in the real estate profession, such as sales, brokering, appraising, researching, or sale of realty information and escrowing realty accounts, is strictly prohibited. Refer to Personnel Policy 2514 Conflict of Interest.

236.6.1.4 Employment of Retirees

Human Resources, Personnel Policy Manual, Policy 0514, Employment of Retirees, governs contracting for appraisal or other realty and relocation services by retirees.

236.6.1.5 Separation of Functions

- A. Valuation Limit

- The same individual may value and negotiate for simple acquisitions with compensation of $35,000 or less (excluding fence), and valued by a Waiver Valuation. Valuation conclusions less than $35,000 and prepared on other than a Waiver Valuation (for complexity purposes) must be negotiated by personnel other than the valuer.

- B. Relocation Restriction

- An appraiser, having appraised a given parcel containing occupied improvements, may compile a rental subsidy study or replacement housing comparison record for that given property.

236.6.1.6 Use of Forms

The forms provided shall be used without alteration, to the extent practical. Since appraisals and Waiver Valuations may be provided to property owners, each report should contain all necessary supporting information to make the report complete and informative.

Use of alternative sale forms by fee appraisers is addressed in EPG 236.6.3.5.D.

236.6.1.7 Commission Member and Employee Property Valuation

See EPG 236.3.4.9 Acquisition of Property from an Employee or a Commissioner of MHTC.

236.6.2 Scope of Assignment

236.6.2.1 Scope of Assignment

49 CFR 24.103 requires minimum requirements for appraisals consistent with established and commonly accepted appraisal practice, including all relevant and reliable approaches to value. These appraisal requirements accommodate an appraisal reporting level commensurate with complexity. Uniform Standards of Professional Appraisal Practice (USPAP), (see EPG 236.6.3.1.d.17), contains a “Scope of Work Rule”, which requires identification of the problem to be solved, determination and performance of the scope of work necessary to develop credible assignment results, and disclosure of the scope of work in the report. To fulfill the objectives of the CFR and USPAP, the Missouri Department of Transportation (MoDOT) has developed the Scope of Assignment process to assure appraisal reports meet reporting requirements, appraisal principles and standards, and provide a high quality appraisal document. The Scope of Assignment preparer must be familiar with the requirements of the various formats (see EPG 236.6.3 Valuation Formats and Instructions).

All Scope of Assignment documents will be prepared by an individual familiar with all appraisal requirements for proper appraisal practice, approaches to value, rules and laws relevant to valuation for condemnation purposes, 49 CFR, USPAP, etc. The scope will identify the anticipated minimum requirements for an appraisal document to address all issues resulting from acquisition from a property. The Scope of Assignment preparer shall assign a level of documentation consistent with the complexity and anticipated value conclusion range of each acquisition. The assignment criteria must assure adequate documentation yet not assign or pay for more work than meets MoDOT’s needs.

The Scope of Assignment, Form 6.2.2, can be used as a working document throughout the life of the appraisal work for a project.

236.6.2.2 Scope of Assignment Processes

A Scope of Assignment may merely direct an appraiser experienced with MoDOT formats and their instructions, what format to use along with any special instructions. Otherwise, a more detailed Scope of Assignment shall be used for staff or fee appraisers less experienced with MoDOT formats.

Scope of Assignment for Complex Assignment or Inexperienced Staff and Fee

A Scope of Assignment may indicate the following for each parcel, when applicable:

- 1. Total land area, proposed acquisition area, temporary and permanent easement, etc.

- 2. A description of land and improvements.

- 3. The manner in which proposed highway improvement might affect remaining real property.

- 4. Identify and explain all observed elements of loss or damage.

- 5. Identify curable losses, if any are observed.

- 6. Under all appraisal formats the value estimates must include all fee owned and tenant owned improvements, both affected and unaffected. The scope may authorize the appraiser to estimate the contributory value of unaffected improvements.

- 7. A statement from Commission's counsel with regard to special benefits when it is anticipated that such benefits may accrue to a remaining fee hold.

- 8. An explanation of those appraisal problems that warrant two appraisals on the same parcel.

- 9. A Scope of Assignment may indicate what evidence is required to support depreciation rates for affected improvements when a cost approach is specified. If primary reliance is likely to be placed on the cost approach a higher standard of support for the depreciation estimate should be required.

- 10. A Scope of Assignment may indicate if specialty appraisals to evaluate affected machinery, specialty items, trade fixtures, etc. are required. Also, if MoDOT or the fee appraiser is responsible for obtaining said appraisal and which party is responsible for the cost of specialty appraisals.

- 11. A Scope of Assignment may indicate a suggestion or requirement to engage a contractor to furnish cost to cure estimates for rehabilitating remainder buildings, correcting or revising affected sewer systems, water lines, fence, etc., and if MoDOT or the fee appraiser is responsible for obtaining and the cost of the contractor’s services.

- 12. Approaches to Value

- The sales comparison approach often develops the most credible indication of value. In most situations this may be the only approach necessary to estimate just compensation. The cost less depreciation approach is best applied to newer, special use, or unique improvements not normally transferring in the market place. An income approach may be implemented when appropriate.

- The Scope of Assignment shall indicate the recommended approach or approaches to value "before" as well as "after" when applicable.

- The sales comparison approach shall be shown for parcels where appraiser relies upon vacant land sales and may estimate contributory value of unaffected improvements.

236.6.3 Valuation Formats and Instructions

236.6.3.1 Standard Appraisal Format

Use of the Standard Appraisal Format (Form 236.6.3.1) is required when:

- the appraisal problems are judged complex

- the highest and best use of a property as improved is different than the highest and best use as if vacant

- residential or other major improvements are acquired, unless use of the URAR appraisal is specified.

- there is a change in the highest and best use after the acquisition.

The appraiser shall adhere to the following format and shall include paragraph headings and numbers as shown. The appraisal shall be typewritten on 8 1/2" x 11" paper with the pages numbered sequentially.

These format instructions set out appraisal requirements of the Missouri Department of Transportation (MoDOT) and the Federal Highway Administration (FHWA). It is inevitable that appraisers will occasionally encounter situations that are not specifically addressed herein. In all cases the appraiser is responsible for a credible, adequately documented appraisal. Reasonableness and typical professional appraisal practices are the standard.

There are a number of ownership items and appraisal problems frequently encountered in valuing acquisitions for transportation purposes, on which policies have been established by case law, management decision and precedent. These policies apply to all appraisal formats and are described in EPG 236.6.3.1.D, Other Appraisal Considerations.

A standardized identification block (see example at right) shall be included at the front of the appraisal, without deviation.

Reporting the effective date of appraisal and date of report are required by Code of Federal Regulations (CFR) and Uniform Standards of Professional Appraisal Practice (USPAP). The effective date of appraisal establishes the context for the value opinion, generally the date of last inspection. For condemnation appraisal reports, the effective date will be the date the commissioners’ award is paid into court. The report date with the signature on the certificate should normally be the date the appraisal is complete or turned in for review.

- 1. Owner and Tenant Owner

- Identify owner and tenant owner by address, phone number, etc.

- 2. Purpose of Appraisal

- The purpose of this appraisal is to estimate just compensation due the owners as a result of acquiring land and realty rights as herein described.

- Fair Market Value Definition: Fair market value is the value of the property taken after considering comparable sales in the area, capitalization of income, and replacement cost less depreciation, singularly or in combination, as appropriate, and additionally considering the value of the property based upon its highest and best use, using generally accepted appraisal practices. If less than the entire property is taken, fair market value shall mean the difference between the fair market value of the entire property immediately prior to the taking and the fair market value of the remaining or burdened property immediately after the taking. See RSMo 523.001.

- Do not use definitions from various appraisal organizations and sources. Failure to use the above definitions can result in having the testimony of a witness stricken.

- Intended Use: The intended use of the appraisal report is to assist MoDOT establish of the amount of compensation to pay for the land and property rights to be acquired.

- Intended Users: Intended users of this report are the Missouri Highways and Transportation Commission (the client), the MoDOT, the FHWA and the United States Department of Transportation and persons authorized by the client. Although the MoDOT authorizes a copy of this appraisal report be provided to the owner of the subject property for information only, the owner is not an intended user as defined by USPAP.

- Uniform Standards of Professional Appraisal Practice (USPAP): The appraiser shall include the following statement in the appraisal report:

- USPAP Compliance Statement: This appraisal was prepared according to the contract/assignment from the agency, Missouri Department of Transportation. The intended use of the appraisal is for eminent domain related acquisition and the agency is the only intended user (except as indicated above). The agency bears responsibility for contract/assignment requirements that meet its needs and therefore are not misleading. In combination with the Scope of Assignment and review function, all appraisal reports assigned by the agency identify the problem to be solved, determine the scope of work necessary to solve the problem and correctly complete research and analysis necessary to produce a credible appraisal, and are therefore in compliance with USPAP Standard 1. In that the agency is the only intended user of the report and others may only be provided copies for informational purposes, the agency has determined that reports prepared in conformance with these procedures constitute an Appraisal Report, which fulfills the agency’s needs. For any inconsistencies with USPAP, appraisers are protected by the USPAP Jurisdictional Exception provision.

- 3. Interest Appraised

- The interest appraised will normally be fee simple interest. If the ownership is encumbered with a lease, the value conclusion may be a leased fee estate. Easement encumbrances impacting market value shall be identified.

- 4. Scope of Work

- Reference the information researched and the analysis applied in an assignment. Appraisers have a responsibility in determining the appropriate scope of work for an appraisal assignment. Credible assignment results require support by relevant evidence and logic. Scope of Work includes, but is not limited to:

- The extent to which the property and comparable sales were inspected

- The extent of data research

- The extent of analysis applied to arrive at opinions or conclusions.

- The Scope of Work is supplemented by the Scope of Assignment (Form 236.6.2.2), a document prepared by individuals other than the appraiser, and setting out the minimum reporting requirements of the appraisal.

- 5. Identification of the Property

- The real estate involved in the appraisal can be specified by a property description, address, map reference, copy of a survey or map, property sketch and/or photographs or the similar information. Lengthy property descriptions should not be reiterated within the report, but rather copies of the title report or last deed of record should be reviewed by the appraiser and retained in the appraiser’s work file.

- 6. History of the Property

- The appraisal report must state the history of the property and cannot merely say, "No transfers" or "none". Indicate all transfers of subject realty for the five years immediately preceding the date of the appraisal. Show the parties to the transactions, dates of transactions, books and pages, instrument numbers and verified sale prices when possible to obtain. If sales of the subject are comparable sales in the report, reference to them will satisfy the requirement of this section. Include details of any current sale agreement, option or listing of the subject property if such information is available to the appraiser in the normal course of business. If the information cannot be determined, the report should state the reasons. If the report states there has been no sale, contract, option, or listing, it must also state how that determination was made.

- Good appraisal practice dictates that appraisers consider and analyze recent sales, contracts, options or listings of the property being appraised. If, in the appraiser’s opinion, any of the above does not reflect current value of the property, the appraiser must provide reason. The phrase "not an arms length transaction" is not adequate without explanation.

- 7. Description of Property Before Acquisition

- A. Zoning:

- The applicable code and category of zoning should be stated (for example, R-1 (the code), Single-Family District (the category)). Special zoning provisions or restrictions should be noted, such as minimum lot size or number of developed units allowed. The report should state whether the subject property is in conformance with the zoning code.

- If the subject is non-conforming, the highest and best use and value analysis sections of the report must deal with any effect of the non-conformity upon use and value. Probability of zoning change should be addressed in the highest and best use analysis.

- Code

- Category

- Compliance

- None

- B. Land:

- Site description should include dimensions, shape, size and frontage as appropriate. Describe the topography, roads or streets and frontages, legal access rights and physical entrances, and all non-structural site improvements including but not limited to paving, curbing, retaining walls, landscaping, ponds and terracing.

- If agricultural land, information on soil types and productivity, percent cleared and timbered, and historic uses such as cropland and pasture land may be appropriate.

- Information should be included on encumbrances, recorded or unrecorded, such as deed restrictions, limitation of access, utility easements, flowage or drainage easements, etc. which may affect market value.

- Access Before Acquisition: The report shall discuss the available legal and physical access of the subject property as well as the comparable sales. Legal access represents a deeded or permitted access point to a property. Physical access merely reflects the presence of existing entrances, which may or may not be legal.

- Utilities In Use Before Acquisition:

- Utilities Available Before Acquisition: Identify what utilities are in use, whether public or private, and what utilities are reasonably available to the property.

- C. Fee Owned Improvements, Fixtures and Personalty:

- These items shall be inspected, identified and described in sufficient detail to indicate their uses, quality, condition and location upon the premises.

- The description of affected improvements shall include such items as significant deferred maintenance, recent renovation and a statement of actual and effective age.

- Unaffected improvements shall be inspected to the extent that they can be adequately described. If directed in the Scope of Assignment, the appraiser may estimate the contributory value of unaffected improvements without support.

- The appraiser shall identify and value personal property, trade fixtures, or intangible items that are not real property but are impacted by the acquisition and are included in the valuation. When there are items such as appliances, fireplace inserts, equipment, on-premise signs, mobile homes, etc., which could be realty or personalty, the report shall identify them and state whether they are considered personalty or realty. See EPG 236.6.3.1.D.12 for instructions on personalty and fixtures.

- When appropriate the impact of Title III of the Americans With Disabilities Act of 1990 as outlined in EPG 236.6.3.1.D.1, Other Appraisal Considerations should be addressed.

- D. Tenant Owned Improvements, Fixtures and Personalty:

- All buildings, structures or other improvements, except outdoor advertising structures, which are a part of the realty and owned by someone other than the fee holder shall be valued as such items contribute to the fee or valued for removal (salvage), whichever is greater.

- The report shall identify the terms of the lease and describe buildings, structures or other improvements owned by someone other than the fee holder, which the tenant has the right or obligation to remove at the expiration of the lease term.

- All tenant owned improvements including outdoor advertising structures shall be identified and described as separate assets from that of the fee holder. Follow instructions for describing improvements in Paragraph 7C of this section. See EPG 236.6.3.1.D.12 for instructions on personalty and fixtures.

- When appropriate the impact of Title III of the Americans With Disabilities Act of 1990 as outlined in EPG 236.6.3.1.D, Other Appraisal Considerations should be addressed.

- E. Other Appraisal Considerations:

- Methods and directions for addressing other property elements are set out in EPG 236.6.3.1.D.

- 8. Highest and Best Use Analysis Before Acquisition

- The appraiser shall analyze the highest and best use before acquisition to the extent commensurate with the appraisal problem. Estimation of market value requires consideration of the highest and best use or uses for which the property is suited. Conclusion of highest and best use of vacant land should be consistent with zoning or evidence shall be included supporting the probability of zoning change. If the subject property is unzoned vacant land, highest and best use should be consistent with surrounding land use and area trends or evidence supporting the different use shall be offered. If the highest and best use is the existing use as improved, reasons supporting this conclusion should be explained. If the highest and best use is different from the current use as improved and particularly if other than allowed by current zoning, this conclusion should be supported by market evidence and analysis showing that this use is financially feasible, physically possible, and that there is a high probability of obtaining the necessary zoning. An unsupported statement of conclusion will not meet the requirement for highest and best use analysis in the Standard Format.

- A.Valuation of Properties with Multiple Highest and Best Uses:

- Properties with the potential for multiple highest and best uses may be valued from comparable sales with like potential or as an alternative, the appraiser may value each use area by data comparable to each specific use to reach a value conclusion. Should an appraiser pursue the latter method of evaluation three sales comparable to each specific use area must be included and analyzed in the sales comparison approach, appropriate cost and income data for each use area shall be included if these approaches are utilized, and it must be shown that the owner may convey each specific use area without affecting the value of the remaining area(s).

- B.Valuation of Improvements That Do Not Represent the Highest and Best Use of the Property:

- If improvements do not represent the highest and best use of the property they may have interim use value, depreciated in place value, salvage value (value of salvage exceeds cost of removal), no value (removal cost equals salvage value) or negative value (removal cost exceeds salvage value). The analysis should be clear as to which valuation premise is being used. Compensation for improvements, like fence, that may not contribute to the fulfillment of the highest and best use may be considered when the property was previously fenced and the owner utilizes the property for livestock confinement.

- If a salvage value is included in Paragraph 18 (Salvage Value), the before value of that improvement must be at least equal to that salvage value.

- 9. Valuation Before Acquisition

- Required Approaches:

- Appraisers shall as a minimum complete the approach or approaches to value as specified within the body of the appraisal agreement and/or elements of the Scope of Assignment. If the appraiser determines the appraisal problem is more or less complex than reflected in the Scope of Assignment, it is the appraiser’s responsibility to communicate the necessity to amend the Scope of Assignment, which may necessitate renegotiation of the agreement.

- Each required approach to value, both before and after when applicable, shall be compiled in accordance with accepted appraisal principles and techniques, with appropriate specifications contained in these instructions and in compliance with 23 CFR - Highways and 49 CFR – Transportation.

- Sales of the subject within the past 5 years and current Agreements of Sale, options and listings of the subject property shall be considered and analyzed. In some cases, sales of the subject over 5 years old may still be relevant.

- Sales Data and Other Market Support:

- Each appraisal report prepared on the Standard Appraisal Format shall contain sufficient documentation, including valuation data and the appraiser's analysis of that data, to support the opinion of value.

- Appraisers shall incorporate within the appraisal reports adequate sales and other supporting data to relay the necessary comparative information using Comparable Sale Forms 236.6.3.5.A and EPG 236.6.3.5B.

- The report shall contain a sales map in sufficient detail to allow the reader to drive to each sale.

- A. Sales Comparison Approach Before Acquisition:

- When a sales comparison approach is applicable, an appraiser must analyze such comparable sales data as are available to indicate a value conclusion.

- A comparable sale may be considered as follows:

- a real property transferring on the open market within approximately 5 years of the date of appraisal in which the sale is referenced as a basis for conclusion of value,

- a sold property which is similar and/or suitable for comparison with realty being appraised with regard to land area, shape, location, topography, utilities, improvements when applicable, potential highest and best use(s) and any other sufficiently similar qualities which may enable an informed person to arrive at a reasonable estimate or conclusion of value.

- Pending contracts should be considered but not relied upon.

- Contract for Deed may be used, however, if the contract is not recorded, a copy of the contract must be part of the appraiser’s file.

- Comparable sale data shall be reported in each applicable portion of Sale Form 236.6.3.5.A or Form 236.6.3.5.B.

- A minimum of three comparable sales is required as a basis for an evaluation by the sales comparison approach in the Standard Format, unless a different number is authorized in the Scope of Assignment. An arms-length sale of the subject property may be considered a comparable sale provided the transfer occurred within approximately 5 years of the date of appraisal. Adjustments for changes in market conditions and/or improvements may be necessary to align sale price with current value.

- Each comparable sale shall be compared with the appraised realty and adjustments implemented for each significant element of difference affecting value. An explanation shall be offered for each individual adjustment. Differences may be measured by either dollars or percentage. A lump-sum adjustment for more than one difference is not acceptable.

- The appraisal report shall contain sufficient sales data or other factual data and analyses of such data as to lend credible support to an opinion of each adjustment or value differential applied to the comparable sale. The only exception to this policy shall apply when such supportive data cannot be abstracted by sales analyses and the appraiser so states. Comments regarding adjustments abstracted from or based upon sale analyses shall include reference to the section or page number of the report where the abstraction is explained. Comments sufficient to explain the appraiser's rationale and reasoning shall be offered for each adjustment which could not be supported by sales, sales analyses or other factual data.

- Comparable sales used as a basis for evaluating unimproved land must be either unimproved or all improvements totally and completely depreciated and offering no contributory value at date of sale. The procedure of abstracting estimated contributory value of improvements from selling price to arrive at residual value for unimproved land shall not be considered credible sale evidence or a basis for valuing unimproved realty.

- Use of sales that have improvements located on them as vacant land sales, when it has been confirmed that those improvements did not contribute to value, is acceptable provided that during the course of time that the sale is being relied upon, those improvements have not been rehabilitated for renewed use. Once it becomes apparent that an improvement, formerly concluded to have no contributory value, has been put back into productive use, a sale written to the contrary has lost much of its credibility and is not to be used as a comparable for land valuation.

- Each sale shall be analyzed to yield a value indication for the subject. These value indications shall be reconciled to a value conclusion by the sales comparison approach. A final conclusion of value differing from the range indicated by the comparable sales must be explained in depth.

- Before Value by Sales Comparison Approach: $_______________

- B. Cost Approach Before Acquisition:

- When a cost approach is applicable, an appraiser must:

- develop an opinion of site value by an appropriate appraisal method or technique

- analyze such comparable cost data as are available to estimate the cost new of the improvements

- analyze such comparable data as are available to estimate the difference between the cost new and the present worth of the improvements (accrued depreciation)

- When a cost approach is applicable, an appraiser must:

- When utilizing the cost approach the appraiser shall offer a minimum of three unimproved land sales to serve as a basis for evaluating unimproved land, unless a different number is authorized in the Scope of Assignment. Each land sale must meet the criteria as prescribed for comparable sales in Paragraph 9A of this Section.

- The appraiser shall compare each individual comparable land sale with the subject property. Adjustments to each comparable sale shall be in accordance with specifications set forth in Paragraph 9A of this section.

- Improvement Costs: All elements recited in the cost approach must be substantiated by reference to specific sections of acceptable cost manuals, contractor's estimates, manufacturer's or dealer's cost data or by other appropriate sources. The appraiser may determine the value of nominal or unique elements in the cost approach with the best available method, with the requirement for support relative to the value conclusion.

- The use of either replacement or reproduction cost is acceptable if the following two definitions are properly applied:

- Replacement cost is the estimated cost to construct at current prices a building with utility equivalent to the building being appraised, using modern materials and current standards, design and layout.

- Reproduction cost is the estimated cost to construct at current prices an exact duplicate or replica of the building being appraised using the same materials, construction standards, design, layout and quality of workmanship, and embodying all of its deficiencies, superadequacies and obsolescence.

- Depreciation of Improvements: When completing the cost approach, the appraiser shall determine from market data or by the age/life method the applicable rate of depreciation for residential units, commercial buildings and other principal capital improvements. Improvements of a minor nature may be depreciated based on observed condition. Depreciation rates for mechanical appurtenances and/or trade fixtures may be estimated from age/life data furnished by the manufacturer or supplier, or from accepted cost manuals.

- Before Value by Cost Approach: $____________

- C. Income Approach Before Acquisition:

- When an income approach is applicable, an appraiser must:

- analyze such comparable rental data as are available and/or the potential earnings capacity of the property to estimate the gross income potential of the property;

- analyze such comparable operating expense data as are available to estimate the operating expenses of the property;

- analyze such comparable data as are available to estimate rates of capitalization and/or rates of discount; and

- base projections of future rent and/or income potential and expenses on reasonably clear and appropriate evidence.

- The appraiser shall, when implementing an income approach to value, develop an overall capitalization rate from sales of comparable realty investments, band of investment or other accepted method. Discounting to present value of some income streams may be an acceptable technique. The appraiser shall also offer evidence supporting income and expense estimates.

- Before Value by Income Approach: $_______________

- 10. Reconciliation of Value Before Acquisition:

- If more than one approach to value is used, the appraiser shall correlate the resultant value estimates and explain the rationale for deciding which approach and data provide the best support for the conclusion of value before acquisition.

- Total Value Before Acquisition: $_______________

- 11. Description of Property After Acquisition

- The appraiser shall describe the remaining realty to the extent necessary to provide a word picture of the after condition. If the remainder is substantially changed from the before condition the appraiser shall describe the remainder as if the before condition never existed. Partial acquisitions of a minor nature may best be described by discussing changes caused by the acquisition rather than repeating the contents of Paragraph 7 of this section.

- Impact on Zoning: Describe impact on zoning.

- Access After Acquisition: The report shall discuss the available legal and physical access of the subject property as well as the comparable sales. The report must address if the legally provided access points are comparable to the physical access available to the property before the acquisition in regard to topography, timber, etc. See EPG 236.6.3.6 for applicable laws and definitions regarding access.

- Impact on Utilities: A statement is required regarding the impact, if any, on all public and private utility services which the property has in use or available in the before condition. Special considerations apply when it is necessary to to adjust the property owner’s service lines located on existing right of way. The cost to move and reconnect service lines that lie within the existing right is not compensable to the owner if such reconnection is included in the construction contract. See EPG 643.2.1.6 Service Lines Owned by Property Owners.

- Utilities In Use After Acquisition:

- Utilities Available After Acquisition:

- Other Appraisal Considerations:

- Methods and directions for addressing other property elements are described in EPG 236.6.3.1.D.

- 12. Highest and Best Use Analysis After Acquisition

- The report may indicate that the highest and best use of the remaining realty is unchanged and an explanation supporting such a conclusion is required. Should the acquisition cause a change in highest and best use or uses, the appraiser shall analyze the new highest and best use in depth commensurate with the appraisal problem.

- Loss of access, loss of traffic, circuity of travel, placement of a median barrier, loss of visibility, loss of privacy, loss of security, etc., are to be considered elements by the appraiser in formulating an opinion of the highest and best use of the property in the after condition. If the appraiser determines there is no diminution in highest and best use of the property, even though these elements are present, the appraisal report is to include an explanation supporting such a conclusion.

- The change(s) caused by the property acquisition may make it necessary for the appraiser to utilize new comparable sales data. Special Benefits reflected in a report must be supported by written concurrence from Commission's Counsel and addressed in the Scope of Work of the report if special benefits are recognized subsequent to the initial Scope of Assignment.

- 13. Valuation After Acquisition

- The analyses and valuation sections relating to the remainder property constitute a new appraisal. In cases of an insignificant acquisition, the remainder may be so similar to the whole property before the acquisition that the same highest and best use analysis and the same cost, market, and income data and analysis will remain applicable and can therefore be referenced and employed in analyzing and valuing the remainder property. However, a change in the basic physical or economic character of the remainder may result in a change in the remainder’s highest and best use or the intensity of that use and may result in damages or benefits to the remainder property which will require different market data and/ or analysis than that which was used in the whole property valuation.

- Follow instruction as shown in Paragraph 9 of this section as well as EPG 236.6.3.1.D.

- A. Sales Comparison Approach After Acquisition:

- Follow Instructions as shown in Paragraph 9A above.

- After Value by Sales Comparison Approach: $_______________

- B. Cost Approach After Acquisition:

- Follow Instructions as shown in Paragraph 9B above.

- After Value by Cost Approach: $________________

- C. Income Approach After Acquisition:

- Follow Instructions as shown in Paragraph 9C above.

- After Value by Income Approach: $_______________

- 14. Reconciliation of Value After Acquisition

- If more than one approach to value is used, the appraiser shall correlate the resultant value estimates and explain the rationale for deciding which approach and data provide the best support for the conclusion of estimated value after acquisition.

- Total Value After Acquisition: $_______________

- 15. Estimate of Total Just Compensation

- Total Just Compensation is computed by subtracting the estimated value after the acquisition from the estimated value before the acquisition.

- Estimated Value Before Acquisition $_______________

- Estimated Value After Acquisition $_______________

- Indicated Just Compensation Due to Acquisition $_______________

- 16. Allocation of Just Compensation

- The appraiser shall offer an opinion of reasonable allocation of the estimate of just compensation between realty acquired and damages to the remainder for .the interests of both fee holders and tenants who own improvements, fixtures or personalty included in the value.

- A. Allocation of the Fee Holder’s Interest:

- 1. Land Acquired: $ ______________

- Report the calculated value of the land acquired.

- 2. Improvements, Fixtures and Personalty: $_________________

- 3. Total Land and Improvements, Fixtures and Personalty: $_________________

- 4. Damages to the Remainder: $_________________

- Damages to the remainder including permanent and temporary easements shall be identified and individually valued, and their values combined to a total. Losses caused by temporary borrow pits must be set apart from other damages. Fencing required as a cost to cure due to road realignment, temporary fencing etc. shall be included as a damage to the remainder. See additional discussion on Damages in EPG 236.6.3.1D.

- 5. Total Just Compensation Due Fee Holder: $________________

- B. Allocation of the Tenant Owner’s Interest:

- 1. Tenant Owned Improvements, Fixtures and Personalty:

- Item _________________ $_________________

- Item _________________ $_________________

- Identify each tenant owned improvement within the new acquisition and/or easement area and estimate its value. Use the greater of its contributory value or value for removal (salvage value).

- 2. Damage to Tenant Owned Improvements, Fixtures and Personalty:

- Item _________________ $_________________

- Item _________________ $_________________

- Identify and show a value loss, if any, for each damaged tenant owned improvement lying outside the acquired area.

- 3. Leasehold Interest: $_________________

- Calculate value of leasehold interest, if any, should the lease be affected by the acquisition.

- 4. Total Just Compensation Due Tenant Owner: $________________

- 17. Uneconomic Remnant

- "The term uneconomic remnant means a parcel of real property in which the owner is left with an interest after a partial acquisition of the owner's property, and which the acquiring agency has determined has little or no value or utility to the owner." (see 49 CFR Section 24.2 (27) and EPG 236.5.9.1 Definition (in EPG 236.5 Property Management). When the appraiser is of the opinion that an uneconomic remnant does not exist, enter the word "none" in this paragraph. When the appraiser is of the opinion that an uneconomic remnant has been created by the acquisition, an explanation is required. The appraiser shall describe elements that contribute to a parcel having some characteristics of an uneconomic remnant, yet conclude that the parcel is not an uneconomic remnant. A separate area and value should be shown for multiple uneconomic remnant areas.

- Area __________________ @ $ __________ = $ ________________

- 18. Salvage Value

- "The term salvage value means the probable sale price of an item offered for sale to knowledgeable buyers with the requirement that it be removed from the property at a buyer’s expense (i.e., not eligible for relocation assistance). This includes items for re-use as well as items with components that can be reused or recycled when there is no reasonable prospect for sale except on this basis."

- Each acquired improvement enumerated above shall be additionally identified under salvage and a salvage value determined or zero indicated. Salvage values should not be assigned to very low value items such as farm fencing. If an improvement has salvage value, the before value of such improvement must be at least equal to the salvage value.

- Allocate salvage values between fee and tenant improvements, fixtures and personalty.

- Improvement ______________ Salvage Value $_________________

- Improvement ______________ Salvage Value $_________________

- Total Salvage Value ______________ $_________________

- 19. Required Attachments

- Assumptions and Limiting Conditions: The appraiser shall use the standard Assumptions and Limiting Conditions (Form 236.6.3.1.A). If additional contingencies or limiting conditions apply, they shall be stated here. Unauthorized hypothetical conditions, assumptions, or limiting conditions may result in disapproval of the appraisal report.

- Certificate of Appraiser: A properly completed and signed copy of Certificate of Appraiser (Form 236.6.3.1.B) shall be attached to the appraisal report.

- Site Plan: The appraiser must provide a site plan showing all property boundaries and the location of major and affected improvements. An annotated copy of an assessor’s aerial map, a survey, an aerial photo, a cut of the highway plan can meet this requirement if it shows the whole property and all improvements, or a drawing. If other than the plan cut is used to meet this requirement the site plan should show the proposed boundary line and easements, and the areas of the acquisition and remainder. Greater detail and a higher degree of accuracy is required on small parcels or where improvements are very near and possibly affected by the acquisition than on large parcels where improvements may be important to the value estimate but are not affected by the acquisition.

- Photographs: The appraiser shall attach identified color photographs of the appraised property showing all improvements and features affecting the value. Photographs should show details important to the valuation of major and/or affected improvements. Photographs should also show the area of acquisitions including easement areas and their relationships to affected improvements.

- Floor Plans of Acquired Residential Units And Structures with Internal Walls: A floor plan drawing is required when:

- a residential unit is acquired, to aid in the determination of relocation requirements and benefits.

- demolition will be required on structures with interior walls.

- Comparable Sale Map: The report shall contain a sales map in sufficient detail to allow the reader to drive to each sale.

- Sale Data Forms: Data books may be utilized in each appraiser’s practice but shall not be submitted to division or referenced in reports. Each appraisal report prepared on the Standard Appraisal Format shall contain sufficient documentation, including valuation data and the appraiser's analysis of that data, to support the opinion of value.

- Appraisers shall incorporate within the appraisal reports adequate sales and other supporting data to relay the necessary comparative information. Sale data sheets, Forms 236.6.3.5 A and B utilized in the valuation shall be attached to each report. The entirety of information obtained on each sale transaction may exceed the need for each individual report, like income data, etc. Individuals may develop abbreviated sale data sheets that contain only the information necessary for comparison to the subject valuation, with other data retained in the appraiser’s work file.

- Optional Attachments

- Cover letters

- Tables of Contents

- Appraiser Qualifications

- Engagement Letter or Notice to Proceed

- Legal Instructions, if any shall be retained in the appraiser’s work file and not attached to valuation reports.

- Optional Attachments

- A. Assumptions and Limiting Conditions

- Assumptions and Limiting Conditions (Form 236.6.3.1.A) shall be attached to each Standard Format and Value Finding appraisal, and other valuations where it is deemed appropriate.

- B. Certificate of Appraiser

- Certificate of Appraiser (Form 236.6.3.1.B) shall be attached to each Standard Format and Value Finding appraisal, and other valuations where it is deemed appropriate. The Certificate of Appraiser is not used on Waiver Valuations.

- C. Tenant Summary

- Summary Value of Tenant Interests, Form 236.6.3.1.C, shall be prepared and provided to tenant owners of improvements and interests affected by an acquisition. Form 236.6.3.1.C is a summary of tenant information and valuations included in the valuation of the parent property, but is not to be attached to the appraisal or valuation documents provided to the fee owner.

- D. Other Appraisal Considerations

- The following elements shall be considered and addressed in the appropriate paragraphs of all valuations.

- 1. Americans With Disabilities Act of 1990

- The intent of this section for the appraiser is to emphasize the importance of the impact of the ADA on real estate valuation. Appraisers must be aware of differences in apparently comparable improved properties due to ADA. It is not intended that appraisers unduly seek out ADA deficiencies in affected and acquired improvements.

- The appraiser should be aware of the requirements of Title III of the Americans With Disabilities Act of 1990 and consider its effect on the value of the appraised property. The Act applies to any public accommodation, commercial facility, or private entity that offers examinations or courses related to applications, licensing, certification or credentialing for secondary or post-secondary education, professional or trade purposes. When a public accommodation is located in a private residence that part used for public accommodation is covered by this act, including those elements used to enter the place of public accommodation.

- The Act requires removal of architectural barriers and communication barriers that are structural in nature in existing facilities, where such removal is readily achievable, i.e., easily accomplished and able to be carried out without much difficulty or expense. Whether a measure is readily achievable is determined on a case-by-case basis, however, the obligation to remove barriers is a continuing one. What was not readily achievable in the past may become achievable in the future and the Act envisions a gradual removal of barriers and suggests priorities for their removal.

- All new improvements after January 26, 1993 must be designed and constructed to be readily accessible and usable by individuals with disabilities. Alterations to existing facilities after January 26, 1993 must to the maximum extent feasible ensure that the altered portions of the facility are readily accessible. When undertaking a cost to cure as part of the damages caused by a property acquisition, the appraiser will have to consider how the acquisition affects accessibility as well as whether the improvement was or should have been in compliance prior to the acquisition.

- Subject property shall be inspected on the date of valuation for its compliance or non-compliance with ADA regulations. All comparable sales used in the valuation process should be analyzed as to their compliance or non-compliance to ADA regulations as of the date of sale. If subject property is currently in non-compliance with ADA regulations the appraiser should use similar comparable sales, which are in non-compliance for comparison purposes. It shall be the appraiser's responsibility to estimate the current market value of subject property as it now exists taking into consideration all of its compliance or non-compliance of ADA regulations and making adjustments for either situation. Curing damage to the remainder could trigger requirements of ADA. This must be considered in any after value analysis.

- 2. Billboard Valuation

- For further information on the acquisition of billboards, see EPG 236.16.9 Sign Structures/Junkyards Affected by Highway Projects. The following definitions are for valuation purposes and are linked to locations where other definitions of the subject are available for different purposes.

- A. Definitions:

- Billboard: An outdoor advertising structure that is described within the outdoor advertising industry as a flat surface (panel, wall, or fence, etc.) on which bills are posted. Specifically, a large panel designed to carry outdoor advertising intended or used to advertise or inform of activities conducted away from the premises or services and/or products provided somewhere other than the premises where the structure is located. It advertises an establishment, merchandise, service or entertainment that is not sold, produced, manufactured or furnished at the property on which it is located.

- Billboards along with their supporting structures are considered realty. Billboards should not be confused in the appraisal process with on-premise signs.

- Although billboards are the dominant form of outdoor advertising, other forms such as an outdoor sign, display, device, figure, painting, drawing, message, plaque, or poster may also be considered as outdoor advertising. The valuation of these other forms of outdoor advertising should follow the procedures stated herein.

- For purposes of valuation, the terms billboard and outdoor advertising structure are used interchangeably. Outdoor advertising is defined at 226.510 RSMo.

- On-premise Sign: An on-premise sign advertises activities, services and/or products offered by the establishment on the premises that it is located. On-premise signs may be realty or personalty. On-premise sign is defined at 7-CSR 10-6.015(25).

- Status of Billboard Structures: The status of billboard structures is conforming, conforming out of standard, nonconforming or illegal.

- Conforming Billboard Structures comply with all current billboard regulations.

- Conforming Out of Standard Structures fail to meet the current statutory and administrative rule requirements but comply with the terms of the federal state agreement and meet the statutory requirements of 1999. (Refer to EPG 236.16.7.3 Conforming Out of Standard; 7 CSR 10-6.040(7)).

- Nonconforming Billboard Structures do not comply with all current billboard regulations, but did comply at one time, have a permit, and may remain in place until destroyed. Nonconforming is defined at 7 CSR 10-6.015(24).

- Illegal Billboards Structures may have a permit, but are damaged, do not comply with current statutes, or have other legal limitations.

- Status of Billboard Sites: The status of improved billboard sites is either legal or illegal. The status of a permitted but unimproved site will always be legal.

- Legal Billboard Site is a location on a property that has attained the legal status for construction of a billboard, including the presence of a qualifying commercial enterprise and spacing from other permitted locations. The Outdoor Advertising Specialist can identify current status and spacing requirements. (See Status below.) If zoned, the zoning must accommodate billboards.

- Illegal Billboard Site will generally be associated with a structure that has been erected without a permit, or it is in conflict with a permit regarding location or other issues.

- Eliminated Billboard Site: If an improved billboard site is within the proposed acquisition area, or otherwise impacted by a project, the site shall be considered eliminated if there is inadequate remaining size, if the qualifying commercial enterprise has been eliminated, adequate spacing is not available, local requirements, or other reasons identified by the appraiser. Limitation of access may impact legal billboard sites.

- B. Property Description:

- The description of billboards shall include size, structural components, lighting, condition, maintenance, recent renovation and a statement of actual and effective age. All tenant owned billboards shall be identified and described as separate assets from that of the fee holder. Regardless of impact by the acquisition, billboard structures shall be inspected to the extent that they can be adequately described and that valuation may be accomplished if acquired, or a contributory value may be estimated if unaffected by the acquisition.

- For valuation purposes, the size of a billboard site may not need to be identified, as long as the billboard use does not diminish other uses on the land, or other uses on the land do not diminish the additional contributory value as a billboard site or structure.

- The billboard site and each component of the outdoor advertising structure may be under different ownerships. The status of each billboard site and structure, affected by the acquisition, must be reported in the appraisal. (A legal site may contain an illegal structure, etc.) Fee and staff appraisers shall secure information on status of billboards and administrative hearings from the Outdoor Advertising Permit Specialist. District right of way personnel shall request, the Outdoor Advertising Permit Specialist to prepare an Outdoor Advertising Profile Report (ADV Profile Report).

- C. Compensation:

- Compensation shall be paid for legal sites, conforming structures and non-conforming structures eliminated by an acquisition.

- If a billboard structure or site that is illegal or scheduled for administrative hearing is encountered in the acquisition, consult regional counsel to determine if compensation must be included or omitted in the valuation, and state the findings and conclusion in the report.

- If after the acquisition of an improved billboard site, the remaining spacing is such that one cannot identify which of two or more tracts might be able to obtain a permit for a replacement site, valuations must include compensation for improved sites that are eliminated but may be replaceable, and not speculate on which of several owners might achieve the permit.

- D. Valuation:

- Federal regulations require that all applicable, relevant and reliable approaches to value be considered in valuing billboards. Therefore, as in the valuation of all property types, all relevant approaches to value are to be considered and included in the report, when practicable. When the landowner also owns the billboard, and the billboard and site are being acquired, contact the Right of Way Section, and additional arrangements will be made for the valuation. The appraiser may estimate the value of billboards and their sites by the most relevant and reliable approach, and include the result in the total overall value. The appraisal must state why any approach is not used.

- The valuation of billboard sites that are part of a larger ownership, may utilize market information from comparable sales of sites or capitalization of rents of comparable sites. This site value conclusion may then be added to or included in the concluded realty value of the overall ownership.

- A special larger parcel valuation situation may arise if the landowner owns the billboard and also advertises the billboard owner's business, service or product, which is provided at other premises. When this ownership combination occurs, and the site and structure are acquired, contact the Right of Way Section and regional counsel.

- Sales Comparison Approach: A Sales Comparison Approach may be developed using comparable sales of improved billboard sites, improved with structures similar to the subject’s structure. Elements of comparison might include traffic count, height, lighting, proximity to towns or commercial development, direction of travel, visibility, etc.

- Income Approach: When a billboard acquisition necessitates an income approach, contact Right of Way Section, for additional guidance or arrangements will be made for the valuation. In all ownership combinations, the income derived from the rent received for the land and structure is to be considered in developing an income approach to determine the contributory value of the billboard and supporting land. Income from the sale of advertising displays posted on billboards shall not be considered as income imputable to the realty.

- Comparable rental data can be developed with information from landowners who rent their structure to a second party who places advertising on the structure. Capitalization rates must be supported. Use of the band of investment method of developing a capitalization rate is acceptable.

- In valuing billboard sites, the appraiser shall determine potential economic rent for the subject site. Such rent shall be estimated by comparing the subject site to comparable leased premises. Potential economic rent shall be capitalized at an appropriate rate to determine the current estimated value of the sign site. The appraiser shall explain or support the overall capitalization rate used. Legal status and remaining functional life of the site may impact the selection of the capitalization rate.

- Cost Approach: The appraiser shall estimate the value of billboards and their sites by the cost less depreciation method and include the result in the total overall value. The Cost Approach shall always be developed, regardless if other approaches are also used. Costs for the structures shall be compiled by the unit in place method, quantity survey method or contractor estimate with depreciation measured by the most appropriate means available. Cost sources are to be supported as defined in EPG 236.6.3.1.9B.

- The district is encouraged to contract for cost estimates of replacement or reproduction cost with local sources. It is the appraiser's responsibility to apply estimated depreciation to such estimates to the extent indicated by its current physical condition.

- Reset Option: Signs meeting the reset requirements are classified as Conforming Out of Standard and will be eligible for compensation to reset the sign within the same property or on an adjoining property. One bid will be collected from another sign company supporting the cost of the sign reset. The bid will be included in the appraisal.

- Reconciliation: The basis for the appraiser’s reconciliation of the approaches to a final value estimate should be based on their consideration of the relative strengths and weaknesses of each approach utilized.

- E. Distribution of Fee Holder and Tenant Interest:

- The appraisal report shall identify the site’s annual contract rent, remaining term of the lease, and any other provisions pertinent to the income to be received by the landowner. In those cases where the tenant has a lease and the contract rent is less than the economic rent for the sign site, the appraiser shall compute present value of the difference for the remaining lease term. This amount is the leasehold interest. This amount will be subtracted from the landowner’s value of the sign site. The amount shall then be added to the tenant’s interest.

- F. Salvage Value:

- The appraiser shall determine a salvage value. Salvage value is the probable sale price of an item if offered for sale to knowledgeable buyers, including the previous structure owner, with the requirement that it be removed from the property at a buyer’s expense (i.e. not eligible for relocation assistance). This includes items for re-use as well as items with components that can be reused or recycled when there is no reasonable prospect for sale except on this basis. Assignment of a salvage value for billboard structures should specifically address the previous owner’s ability to utilize or move the salvaged item.

- If the appraiser, in consultation with the Outdoor Advertising Permit Specialist, determines that Legal Billboard Sites are readily available, it is acceptable to estimate the salvage value as the value in place at a potential replacement site minus the cost to relocate the sign to a replacement site.

- G. Billboard Valuation Guide:

- The following material is provided as a guide to suggest the minimum items of consideration in valuing a billboard and billboard site, which must be incorporated into an appraisal format, in the appropriate sections. Use Comparable Lease (Form 236.6.3.5.C) for reporting all types of leases.

- Structure Owner

- Site Owner

- Status of the Structure

- Status of the Site

- Permit number and other material from the Outdoor Advertising Permit Specialist.

- Lease Terms: If the lease is not of public record, the appraiser should attempt to secure a copy from the parties. In the event a written lease is nonexistent or unavailable, the appraiser shall make personal inquiry of the parties in an effort to learn of terms and conditions. Data secured from such inquiry shall be entered on the Comparable Lease (Form 236.6.3.5.C)

- Property Description

- Valuation

- Distribution of Landowner and Structure Owner Interests

- Estimated Value to the Landowner

- Estimated Value of Billboard Site

- Less Leasehold Interest, if any

- Landowner Interest in the Site

- Estimated Value to the Structure Owner

- Estimated Value of Structure

- Add Value of Leasehold Interest, if any

- Structure Owner Interest

- Salvage Value

- 3. Borrow Easements, Waste Easements or Haul Roads

- A valuation for an easement for a borrow area or haul road must provide a word picture which would adequately explain what damages will be associated with these easement areas. The description should include the appraiser's understanding of what the site will look like, how much material will have been removed or deposited, what the possible damages to the remainder will be, whether the affected area will be ponded, whether the topsoil will be stockpiled and replaced and whether the area will be seeded and mulched.

- If the acquisition involves a borrow easement or haul road, adjustments must be adequately explained.

- 4. Damages

- Damages as such are not appraised. However, the appraiser shall explain any damages to the remainder property and allocate the difference in the value of the property before and after the acquisition between the value of the acquisition and damages to the remainder. If damages are measured by a cost to cure, the appraiser must justify the cost to cure and demonstrate that the cost to cure is less than the damage would be if the cure were not undertaken.

- Rationale for conclusion of damage to remainder due to easements or other damage shall be explained. Losses to remainder value may result from limitation of direct access, proximity of proposed boundary line to improvements, severance, reduction in size of remainder, configuration of remainder, change in grade, and other effects of acquisition.

- Noncompensable Damages: It is an established principle of law that certain damages, which may occur by reason of a government acquisition of land, are not compensable and, therefore, must be disregarded by appraisers when estimating market value for such acquisitions. Losses of business and relocation expenses have been determined to be noncompensable. Other noncompensable damages include: damage to business, loss of or damage to goodwill, future loss of profits, expenses of moving removable fixtures and personal property, depreciation in value of furniture and removable equipment, frustration of plans, frustration of contractual expectations, loss of customers, and the expense of having to readjust manufacturing operations.

- Easements: An easement can generally be described as an interest in land of another entitling the owner of that interest to a limited use of the land in which it exists, or a right to preclude specified uses in the easement area by others. An easement is an interest less than the fee estate, with the landowner retaining full dominion over the realty subject only to the easement; the landowner may make any use of the realty that does not interfere with the easement holder’s reasonable use of the easement and is not specifically excluded by the terms of the easement.

- Temporary Easements: The appropriate measure of value for the acquisition of a temporary easement is the rental value for the term of the temporary easement, adjusted as may be appropriate for the rights of use, if any, reserved to the owner. Damages that result from temporary construction easements are usually based on the economic or market rent of the affected area for the term of the temporary easement. Usually, the land area affected is so small and the term of the temporary easement so short that compensation for the temporary construction easements is nominal. As a result, many agencies and appraisers have adopted a shortcut for its estimation. A reasonable return rate, rather than the economic or market rent based on comparable rentals, is estimated and applied to the encumbered land’s fee value for the term of the temporary easement. The rent loss or appropriate return is often not converted to a present value through the application of a discount rate because of the short term of the temporary easement and the nominal nature of the indicated rent loss.

- Even though technically incorrect this shortcut is generally acceptable because of the nominal nature of the temporary construction easements acquisition and the cost and time savings associated with the short cut. However, appraisers must recognize that the short cut methodology will be found unacceptable if the indicated compensation is more than nominal.

- In estimating and approving just compensation for temporary easements, the appraiser/reviewer must consider the impact on the use of the area of the property in the temporary easement and the impact of the temporary easement on the remainder.

- Impacts within the temporary easement area can have impact for the duration of the occupancy/use by the contractor, the duration of the anticipated construction time of the project, or the duration of the encumbrance of the temporary easement on the property.

- Temporary easements that impact only during the contractor occupation include driveway reconnection easements, construction of curbs, removal of items, etc. Although a contractor may be on a temporary easement area during different times, (Example: removal, grading, sub-grade, and paving) the appraisal may consider merely the total of time the area is disturbed for construction, when making the calculation for compensation. Unless otherwise indicated, the appraiser is to assume that owners/customers are provided reasonable access to property during construction.

- Temporary easements that impact during the duration of the anticipated construction for the project include temporary bypasses, slope cuts, (slope fills require permanent easement) borrow easements, work and turn areas on parking lots, construction of retaining walls, etc.

- Temporary easements that impact for the duration of the temporary easement encumbrance include large temporary easements on vacant land with development potential, temporary easements that occupy large areas or large proportions of front yards, borrow or waste easements, or any application of easement that might impact market value or the marketability of the property. The duration of the project may include time beginning at the anticipated acquisition, and time until anticipated letting, construction time until anticipated acceptance of the project, which would release the rights in the temporary easement area.

- Temporary easements that may result in damage to remainder outside the actual temporary easement area include temporary loss of access or use of part or all of the property, undesirable borrow areas, etc. MoDOT accepts compensation for temporary easements at 10% of fee value per year, applied to one of the durations discussed above. Appraisal reports must include explanation of the duration used and why that duration was utilized. Different durations may apply to different temporary easement areas on an individual property. Use of other percentages requires analysis and explanation.

- Third Party Appurtenant Easements: This section applies to the proper measure of value for a third party appurtenant easement that is acquired or extinguished as an incident of an acquisition of the servient estate (fee acquisition of property through which an easement of access connects a third party’s parcel to the highway). The third-party easement owner has a separate estate that must be separately appraised. In such cases, the easement owner is not limited to the value of the easement acquired, but is entitled to the value diminution of the property served by the easement. Accordingly, two appraisal assignments are required; a before and after appraisal of the easement interest and the property it serves (the before appraisal including the easement interest and the land it serves and the after appraisal excluding those interests acquired.) and a second appraisal assignment covering the land being acquired, as encumbered by the easement. This second appraisal would also require a before and after appraisal if only a portion of this larger parcel is to be acquired

- Costs to Cure: The Commission’s intent is to make the property owners “whole” in the after condition. As such, if the affected property had previously been surveyed by the current or previous property owners, district right of way shall ensure that this element has been addressed. One way to address this element is by including a cost-to-cure line item in the appraisal to cover the costs the property owners will incur to have a new boundary survey prepared. This element may also be addressed by coordinating with the district PLS to monument the new limits of their remaining property. EPG 238.2.14.3 Monumenting Landowner's Property Lines When Requested contains further guidance related to MoDOT taking responsibility for monumenting the property owners’ new property line.